What Address Do You Send 1099 To Irs

Im not even filing taxes in that state anymore. There are only two mailing addresses for Form 1099-MISC.

:max_bytes(150000):strip_icc()/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg) Form 1099 B Proceeds From Broker And Barter Exchange Definition

Form 1099 B Proceeds From Broker And Barter Exchange Definition

Call 501-682-1675 and speak to John Lewis.

What address do you send 1099 to irs. The mailing address for Form W-2 is the easiest one of all. Box 149213 Austin TX. If you are not e-filing then mail your statements with your entire tax return to your local IRS office.

Section 6071c requires you to file Form 1099-NEC on or before February 1 2021 using either paper or electronic filing procedures. You can quickly find the correct address for your filing in Section D of the General Instructions. Send these forms to.

Internal Revenue Service PO. Austin Submission Processing Center. Mailing Address for Form W-2.

Shipping and Receiving 0254. These are the likeliest boxes you will need to fill out. 4 rows Mailing Address for Form 1099-NEC.

The recipients name and address. Internal Revenue Service. If you already mailed or eFiled your form 1099s to the IRS and now need to make a correction you will need to file by paper copy a Red Copy A and 1096 fill out and mail to the IRS if you need further assistance preparing your corrected paper copy please contact your local tax provider or call the IRS at 800 829-3676.

Box 802501 Cincinnati OH 45280-2501. To learn more about TaxBandits pricing you can click here. Where to file addresses for tax.

Once connected click the name. Each form has its own page with the needed address for example 1040 1040-SR 1040X 7004 and 941. If your agency has purchased real estate for the State without using an agent the state must report this transaction on the form 1099-S.

To get to the area in MTO where you can send income statement information electronically you will need to connect your personal profile to the Treasury-registered business tax account that issued the 1099 forms. Updated on December 18 2020 - 1030 AM by Admin. Internal Revenue Service Attn.

One is in Austin TX. View the Connect to a Business tutorial on the MTO Help Center to create this business relationship. Box 7 is where you put the amount paid in non-employee compensation.

Outside the United States. Tax Exempt and Government Entities. Specific Instructions for Form 1099-MISC File Form 1099-MISC Miscellaneous Income for each.

If you would like to e-file other tax forms such as 941-PR 941-SS 941-X Form 940 Form 943 Form 944 Form 945 Form W-2 1099 series 1095-B and 1095-C you can complete through TaxBandits. Service Bureau agencies must email corrected information to the DFA-OA via the 1099 email address Acct1099AgencyChangedfaArkansasgov on the correction spreadsheet. Department of the Treasury Internal Revenue Service Center Ogden UT 84201.

Is this going to be a problem. Individual corporation partnership and many others. My concern is if the 1099 got sent to the tax authorities of my old state are they going to send me a tax bill.

Austin TX 73344-0254. Internal Revenue Service Austin Submission Processing Center PO. I got my 1099 from my brokerage but it has my old address in a different state that I havent lived in for a couple of years.

The 1099 is a simple form with only 17 boxes most of which you will likely never touch. Box 7704 San Francisco CA 94120-7704 Starting June 19 2021 use this address Internal Revenue Service PO. Your EIN or FEIN.

As long as you can substantiate that you had mailed a Form 1099 MISC to a valid address and information provided by him you will not have the liability for him not receiving the Form 1099. Updated on December 29 2020 - 1030 AM by Admin. Mailing addresses for all types of returns.

Your business Federal Identification Number AKA. Extension of Time Coordinator 240 Murall Drive Mail Stop 4360 Kearneysville WV 25430. Your business name and address.

File Form 1099-MISC by March 1 2021 if you file on paper or March 31 2021 if you file electronically. Where to File Paper Tax Returns With or Without a Payment. Hence it is always advised that when you hire an individual or company to perform services you should FIRST have them fill out a W-9 Request for Taxpayer Identification Number TIN and.

Send a letter to the IRS at the following address. The other one is in Kansas City. Information returns.

Receipt and Control Branch. 3 rows Mailing Address for IRS Form 1099-MISC.

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

Instructions For Forms 1099 Misc And 1099 Nec 2021 Internal Revenue Service

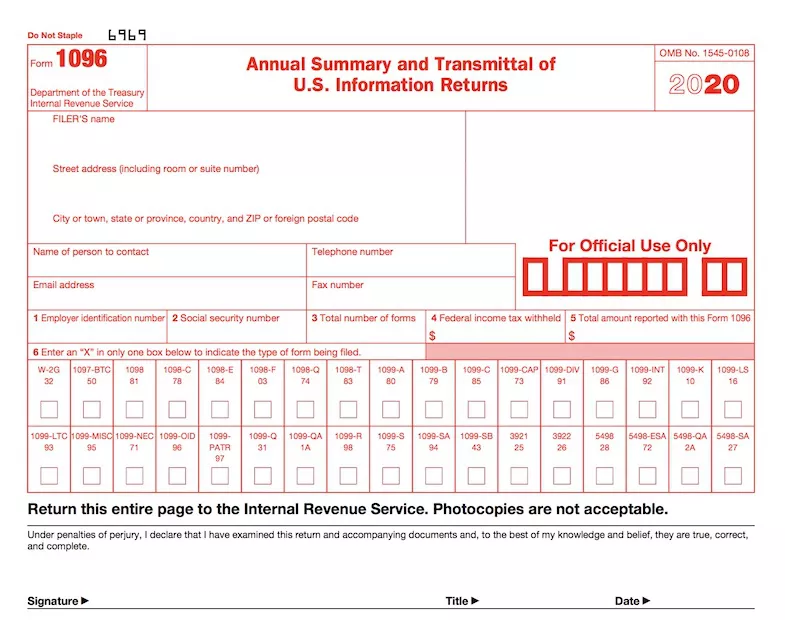

Form 1096 A Simple Guide Bench Accounting

Form 1096 A Simple Guide Bench Accounting

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Nec Instructions And Tax Reporting Guide

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Irs Form 1099 R Box 7 Distribution Codes Ascensus

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

How To Fill Out Irs 1099 Misc 2019 2020 Form Pdf Expert

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager