What Is W8 Form In Fatca

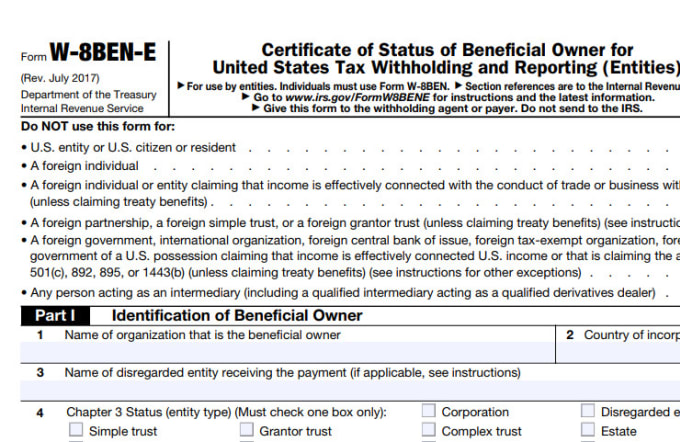

Form W9 is intended for US persons as explained in question 2. The equivalent form that applies to non-US persons is W8-BEN for individuals and W8-BEN-E for entities.

Discuss How To Draft W8 Fatca Form By Existentialwork Fiverr

Discuss How To Draft W8 Fatca Form By Existentialwork Fiverr

Instructions for the Requester of Forms W8BEN W8BENE W8ECI W8EXP and W8IMY.

What is w8 form in fatca. When we speak with finance and accounting teams that work with overseas suppliers and partners one area that causes AP tax compliance issues is dealing with the convolution and complexity that is the W-8 series IRS tax form process. Form W-9 Request for Taxpayer Identification Number TIN and Certification. About Form W-8 BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting Individuals Give Form W-8 BEN to the withholding agent or payer if you are a foreign person and you are the beneficial owner of an amount subject to withholding.

Therefore we have created this FAQ page providing you with information about FATCA and CRS tax legislation as well as about self-certification the reporting process and the consequences of non-compliance. W-9 forms are fairly well understood. Its a single form for dealing with US-based entities and while theres a lot of information on the form.

Taxpayers who hold foreign financial assets with an aggregate value of more than the reporting threshold at least 50000 to report information about those assets on Form 8938 which must be attached to the taxpayers annual income tax return. And CRS Self-Certification instead and. In order to provide customers with further support when completing IRS W Forms we have provided some additional customer guidance for W-9 guidance and W-8BEN-E guidance.

This is a series of forms that are completed to confirm non-US tax status. FATCA requires certain US. Securities the entity must complete the appropriate Form W-8 and CRS Self-Certification instead and should not complete this Form.

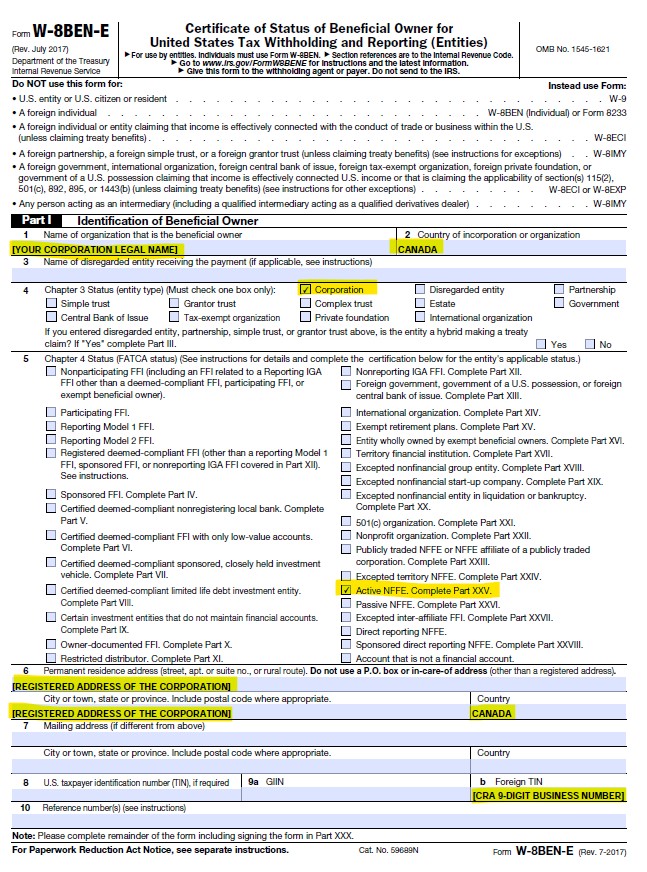

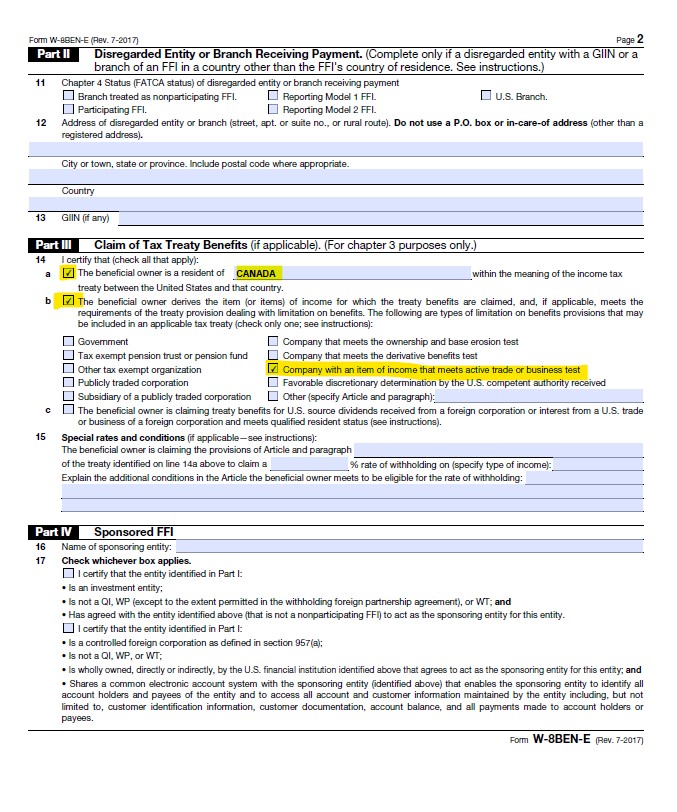

If the entity has a custodial account holding. To make things more confusing the W-8 series contains five different forms that can be used to manage tax requirements for entities that are claiming foreign tax ID status. W-8BEN-E- Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting Entities A Form W-8BEN-E must be completed correctly without any alterations.

This is a series of forms that are completed to confirm non US tax status. Entities having all other FATCA statuses must complete the appropriate Form W-8. If you are a US.

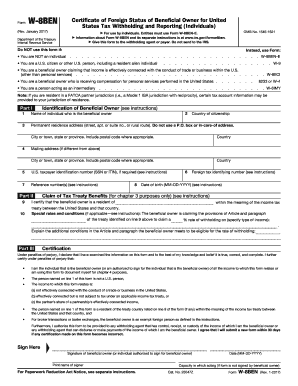

Mark the one box that applies and complete the Part of the Form associated with that FATCA status. If you have been asked to complete our combined FATCACRS form you may have some questions about it. You must give Form W-8BEN to the withholding agent or payer if you are a nonresident alien who is the beneficial owner of an amount subject to withholding or if you are an account holder of an FFI documenting yourself as a nonresident alien.

If you are requested to complete and sign the wrong form for your status inform the form requester of correct status and provide the right form instead. Certify that FATCA codes entered on this form if any indicating that you are exempt from the FATCA reporting is correct. The W8 is a form that must be filled out people or businesses who arent domiciled in the United States but have received income or payments in the USA.

W-8 and FATCA Compliance. Form W-8BEN-E will be required from such entity. Submit Form W-8 BEN when requested by the withholding agent or payer whether or not you are.

A properly completed Form W-8BEN to treat a payment associated with the Form W-8BEN as a payment to a foreign person who beneficially owns the amounts paid. Provide Form W-8BEN to the withholding agent or. Form W-8IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US.

If you make a mistake please start over using a new form. Instead the BEN W8 is a form that certifies the fiscal non-residence in the United States and therefore tax exemption. Branches for United States Tax Withholding.

Guidelines for Completion of the Form W-8BEN-E April 2017 Page 5 of 21 5. Chapter 4 Status FATCA Status. This is a link to the withholding certificates referred to as W8s on the IRS website.

This documentation could be an HSBC declaration or a US tax form from the IRS. W-8 forms are Internal Revenue Service IRS forms that foreign individuals and businesses must file to verify their country of residence for tax purposes and certify that they qualify for a lower. This is a link to the withholding certificates referred to as W8s on the IRS website.

If applicable the withholding agent may rely on the Form W-8BEN to apply a reduced rate of or exemption from withholding at source. Person and a requester gives you a form other than Form W-9 to request your TIN you must use the requesters form if. In order to establish your tax status under FATCA we may need you to provide additional information or documentation.

To determine whether a particular FATCA status applies in. See What is FATCA reporting later for further information. We will be communicating with affected customers that need to complete these forms detailing when they will need to be completed by.

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

How To Complete A W 8 Ben E Form Caseron Cloud Accounting

How To Complete A W 8 Ben E Form Caseron Cloud Accounting

23 Printable W 8 Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

23 Printable W 8 Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Form W8 Instructions Information About Irs Tax Form W8

Form W8 Instructions Information About Irs Tax Form W8

Criminal Tax Considerations Tax Expatriation

Criminal Tax Considerations Tax Expatriation

Https Www Privatebank Citibank Com Taxinformation Docs Guidelinesw 8ben E Fatcaentityclassification Pdf

Https Www Privatebank Citibank Com Taxinformation Docs Guidelinesw 8ben E Fatcaentityclassification Pdf

Https Www Privatebank Citibank Com Taxinformation Docs Guidelinesw 8ben E Fatcaentityclassification Pdf

Criminal Tax Considerations Tax Expatriation

Criminal Tax Considerations Tax Expatriation

W 8 Form Fatca Compliance Management Streamlining Tipalti

W 8 Form Fatca Compliance Management Streamlining Tipalti

W 8 And W 9 Forms For Private Funds

W 8 And W 9 Forms For Private Funds

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

W 8ben E For Canadian Ecommerce Sellers Faqs Sample Baranov Cpa

Filing Of W 8ben E By Canadian Service Provider With A Sample

Https Www Credit Suisse Com Media Sites Fatca Docs W 8ben E Guidance En Pdf

Thoughts On Form W 8ben E For Companies Selling Software Licenses Gonnalearn Com

Thoughts On Form W 8ben E For Companies Selling Software Licenses Gonnalearn Com

Fatca Chapter 4 Tax Expatriation

Fatca Chapter 4 Tax Expatriation

Https Events Iofm Com Conference Fall Wp Content Uploads Sites 4 2017 09 Mon 1100 Makingsenseformsw9w8 M Couch Pdf