Cost Of Business License In Los Angeles County

Search Fee non-refundable 5 per name. Obtaining a Business License Not all businesses must apply for licenses to operate in unincorporated areas of the County.

City Of Los Angeles Business License Financeviewer

City Of Los Angeles Business License Financeviewer

I believe there is a minimum fee of about 60 and it increases from there based on the volume of business one does in the city.

Cost of business license in los angeles county. The company employs a total of 25 people. 0 found this answer helpful 3 lawyers agree. Generally a business is required to be licensed if it is subject to County health or safety regulations.

Please note that additional information may be required. Starting a Business in the County Starting a business in the County requires owners to obtain a business license file for a Fictitious Business Name and other possible steps to get their business. Check with the city for the exact amount.

Please make your check payable to the Los Angeles County Treasurer and Tax Collector. The cost of a Los Angeles County California Contractors License depends on a companys industry geographic service regions and possibly other factors. Due to the ongoing COVID-19 health crisis all mail and online orders are experiencing processing delays.

The business is a family-owned and operated company that serves hospice patients in Los Angeles and Orange County. Renewal Filing Fee for one business name and one registrant. The cost of a Los Angeles California Business License depends on a companys industry geographic service regions and possibly other factors.

The cost of a Los Angeles County California Contractors License is unique for the specific needs of each business. Los Angeles County Treasurer and Tax Collector Business License Tax- Disposal Facilities Unit co Mailroom Room 137B 500 West Temple Street Los Angeles CA 90012-2713. The cost of a Los Angeles County California Sales Tax Permit depends on a companys industry geographic service regions and possibly other factors.

First-time Filing Fee for one business name and one registrant. Business License Section PO. Your business contact information.

Please contact the Treasurer and Tax Collectors Office for information on filing a business license application. 4800 Stockdale Highway Suite 213 Bakersfield CA 93309. The Registrar-RecorderCounty Clerk will close all of its offices to the public effective Monday March 16 as a precautionary measure to help slow the spread of the Coronavirus COVID-19.

The exact business address and primary mailing address for your business location if different from the business location. To pay your Business License application fee in full by check or money order write your Business License ID on the face of the payment instrument and submit the payment along with your invoice to the following address. The City of Los Angeles has an excellent website with a lot of helpful information for anyone wishing to open a new business.

It is a requirement to obtain a business license if such business is conducted in the unincorporated area of Los Angeles County or in the contract cities of Malibu Santa Clarita and Westlake Village. Your legal business name and fictitious name DBA if any. LA County Treasurer and Tax Collector Attn.

The cost of a Los Angeles County California Sales Tax Permit is unique for the specific needs of each business. Prior to opening a business a business name must be selected that is not already in use and then registered. Box 54970 Los Angeles CA 90054-0970.

At LicenseSuite we offer affordable Los Angeles California business license compliance solutions that include a comprehensive overview of. Your business start date in Los Angeles. The Commission is governed by Title 7 of the Los Angeles County Code - Business License with authority in all unincorporated areas of the County and also provides business licensing for Los Angeles County contract cities such as Malibu Santa Clarita and Westlake Village.

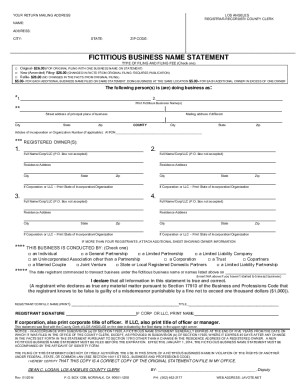

Fictitious business name statements must be filed with the Registrar-RecorderCounty. The business office keeps regular hours Monday through Friday but deliveries are also made during the weekend and staff are available 24 hours a day for emergencies. Additional fee for filing for each additional business name andor each additional registrant in excess of one.

You can also contact the Office of Finance at 213 472-5901 or you can visit the office in person at 200 North Spring Street room 101 in Los Angeles. Responsibilities include investigating and taking action on matters. Effective August 8 2013 new fees for Cottage Food Operator Registrations and Permits will be implemented as approved by the Los Angeles County Board of Supervisors on July 9 2013.

Click the link to your city below to apply for a business license. How much does it cost to become a CFO in Los Angeles County.

City Of Los Angeles Business License Financeviewer

City Of Los Angeles Business License Financeviewer

City Of Los Angeles Business License Financeviewer

City Of Los Angeles Business License Financeviewer

How To Register For A Btrc Los Angeles Office Of Finance

How To Register For A Btrc Los Angeles Office Of Finance

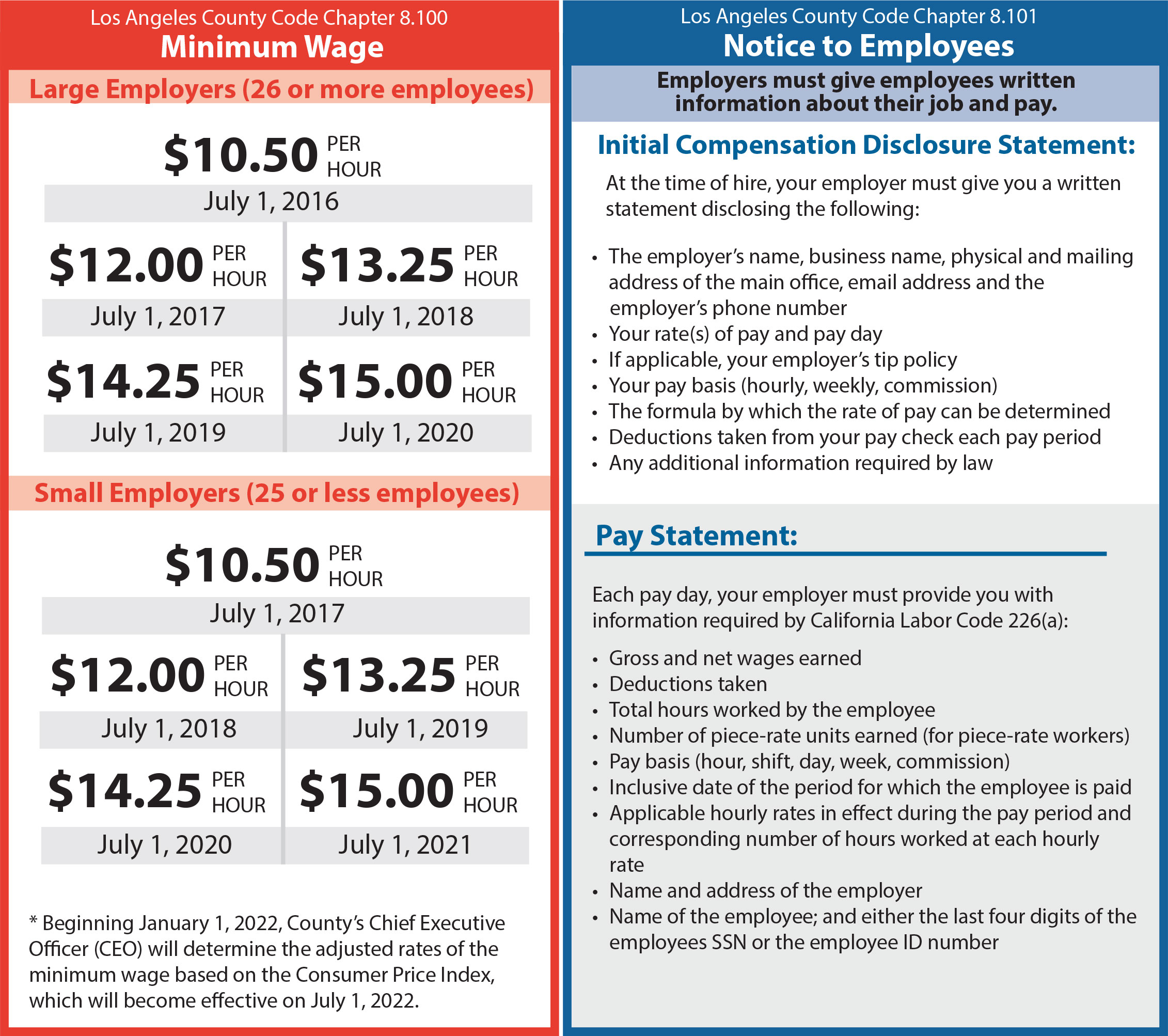

Minimum Wage For Businesses Consumer Business

Minimum Wage For Businesses Consumer Business

When Do California Sellers Need A Seller S Permit Avalara Trustfile Permit How To Apply Seller

When Do California Sellers Need A Seller S Permit Avalara Trustfile Permit How To Apply Seller

Mapping The Cheapest And Most Expensive Places To Rent In Los Angeles Right Now Los Angeles Rent Places To Rent

Mapping The Cheapest And Most Expensive Places To Rent In Los Angeles Right Now Los Angeles Rent Places To Rent

Business License General Information Treasurer And Tax Collector

Business License General Information Treasurer And Tax Collector

Business License General Information Treasurer And Tax Collector

Business License General Information Treasurer And Tax Collector

Business License General Information Treasurer And Tax Collector

Business License General Information Treasurer And Tax Collector

Dba Los Angeles Fill Out And Sign Printable Pdf Template Signnow

Dba Los Angeles Fill Out And Sign Printable Pdf Template Signnow

Business License General Information Treasurer And Tax Collector

Business License General Information Treasurer And Tax Collector

Business License General Information Treasurer And Tax Collector

Local Small Business Enterprise Consumer Business

Local Small Business Enterprise Consumer Business

Lots Of Exciting News In This Navigator Engagement Marketing Community Business Exciting News

Lots Of Exciting News In This Navigator Engagement Marketing Community Business Exciting News

Business License General Information Treasurer And Tax Collector

Business License General Information Treasurer And Tax Collector

Business License General Information Treasurer And Tax Collector

Business License General Information Treasurer And Tax Collector

Official Website Of The City Of Maywood California Businesses Affected By Covid 19

Official Website Of The City Of Maywood California Businesses Affected By Covid 19