Can You Email 1099 Forms To Contractors

Increase retention happiness and loyalty. Confirm with your contractors if they were able to receive the 1099 invites again.

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

The first deadline for 1099-MISC and 1099-K is for delivering the form to contractors and recipients.

Can you email 1099 forms to contractors. When you file forms to declare income for your contractors this becomes a case that is bigger than your own tax return. Send Copy B of 1099 to Independent Contractor. Distribute 1099 forms to your contractors Employers are required to distribute Form 1099s to their independent contractors each year by the end of Januaryfor 2021 the deadline is February 1.

This deadline applies regardless of whether the forms are delivered electronically or via paper snail mail. The forms must be postmarked by January 31. Now send the 1099 Copy B to independent contractors whether via postal mail or hand them personally.

Your vendors have the option to accept or cancel the invitation. Youre required to report the 1099 income earned from your contractor job by yourself. Youll have to click each contractors name to resend the 1099 Form.

From the left panel select Worker and then choose Contractors. So what you may want to do is sent 2 emails. Difference between a 1099 worker and a W-2 employee.

You can use this useful form to determine whether or not you need to send a 1099-NEC MISC form for any independent contractor youve worked with. However the 1099-MISC still has uses as it is used for reporting payments to an individual or LLC in excess of 600 legal settlements or prize or award winnings. Yes if you are using the TurboTax Self-Employed or TurboTax Self-Employed Live online editions or the TurboTax desktop CDDownload Home Business edition or the Business Edition.

If its below you can choose to file via paper though you may find e-filing easier and faster. The benefits of enrolling your team in group health can be enormous for your business whether youre offering the plan to W2 employees 1099 contractors or a mix of the two. The deadline is January 31 of the current tax year.

Email to a Friend. The deadline to send the 1099 MISC Forms to the independent contractors is no later than February 1 2021. Starting with tax year 2020 freelancers will.

While these can be sent electronically recipients have to first agree to receive them electronically so it may be easier to send these by mail especially if youre getting down to the wire. Employers are required to send you a 1099 Form by February 1st 2021. This is because you need to send your contractor a copy of the 1099-NEC.

First youre required to send 1099-MISCs directly to your contractors. 7 years ago. Its beneficial for them to sign up the free account so they can access their copies anytime they want.

Sure but the email will have either your SSN or ein. There are several ways you can distribute the forms including a way to do so electronically with the necessary contractor-consent. In past years if your organization paid a person for services who was NOT an employee you may have needed to file a 1099-Misc for the total amount given over the year.

Can I email a 1099 form to an independent contractor. Some states collaborate to file electronically with the IRS but some dont. For this reason it is especially important to keep your own earnings and expenses records.

11 hours agoIf youre a freelancer or a contract worker you can expect to receive a 1099 form in the mail for each of the people or companies you worked for. The first with the 1099 is encrypted and the second has the key to open n the first. Click on the hyperlinked Send a reminder beside the contractors name.

They can expect their copies within 1-2 weeks after you e-file. Most self-employed individuals will need to pay self-employment tax comprised of social security and Medicare taxes if their. The contractor will file their copy on their tax return.

No law prevents emailing a 1099. You will need to file yours on your tax return. Generally if youre an independent contractor youre considered self-employed and should report your income nonemployee compensation on Schedule C Form 1040 Profit or Loss From Business Sole Proprietorship.

Can I file 1099 misc forms for my contractors using Turbo Tax. Something else you should be aware of is that you must file a 1099 with both the state of the contractor and the IRS. On my Intiut payroll they say you can email 1099s.

I would ask your Contractors to reply to your email just to be on the safe side. Along with all the other changes we have dealt with in 2020 the IRS has also changed how organizations report the money paid to independent contractors or as they prefer to label it Non-employee Compensation. When you e-file 1099 forms through Intuit we mail a printed copy to your vendorscontractors at no additional cost.

How To File 1099 Misc For Independent Contractor

How To File 1099 Misc For Independent Contractor

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

How To Pay Contractors And Freelancers Clockify Blog

How To Pay Contractors And Freelancers Clockify Blog

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

When Is Tax Form 1099 Misc Due To Contractors Email Marketing

When Is Tax Form 1099 Misc Due To Contractors Email Marketing

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Form 1099 Nec What Does It Mean For Your Business

Form 1099 Nec What Does It Mean For Your Business

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

1099 Misc Instructions And How To File Square

1099 Misc Instructions And How To File Square

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

Who Are Independent Contractors And How Can I Get 1099s For Free

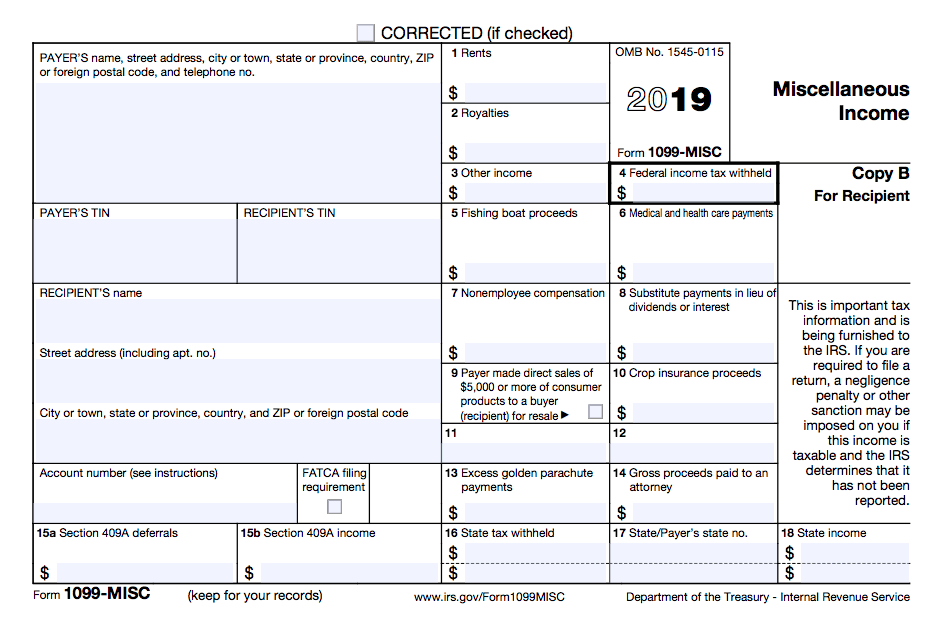

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

What Is 1099 Misc Form How To File It Complete Guide

What Is 1099 Misc Form How To File It Complete Guide