Where Do I Find My 1099-int Form

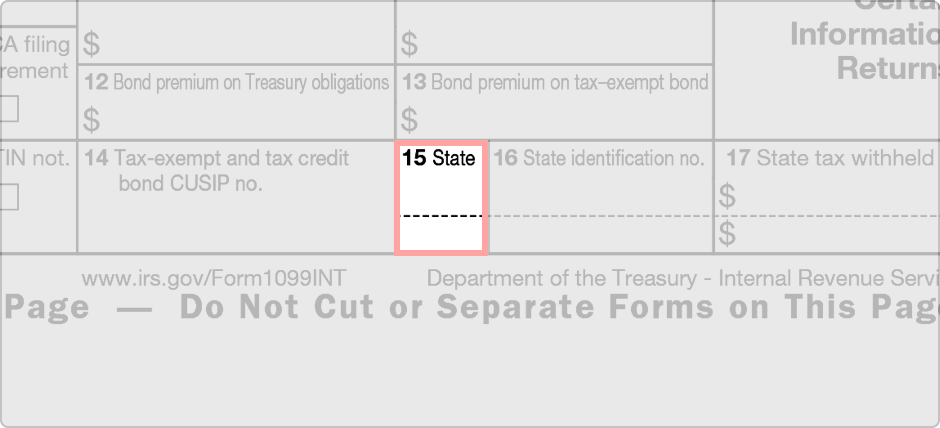

For business accounts call 1-800-225-5935. State tax withheld if any In some cases your 1099-INT may be part of a composite 1099 statement from a broker.

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Form 1099-INT Interest Income statements are not available online.

Where do i find my 1099-int form. Check the organizations website That may be where to find 1099-INT that you can request andor downloadable statements. To replace a lost Form 1099-INT ask the bank or other financial institution that issued it to send you another copy. PO Box 046 Trenton New Jersey 08646-0046 or send correspondence electronically through our NJ ONRS system.

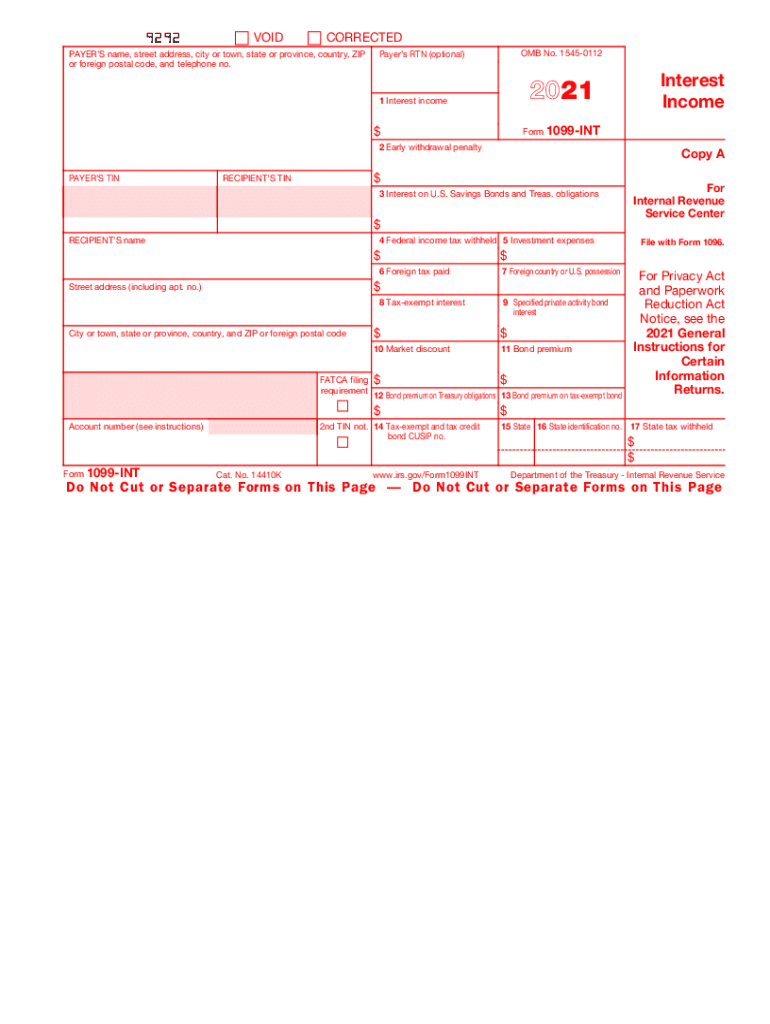

File Form 1099-INT for each person. Box 3 reports interest earned on US. If you receive interest income from more than one financial institution you should receive more than one Form 1099-INT.

Box 1 of the 1099-INT reports all taxable interest you receive such as your earnings from a savings account. You might receive this tax form from your bank because it paid you interest on your savings. Youll find the site ID in the email that we sent you.

From whom you withheld and did not refund any federal income tax under the backup withholding rules regardless of the amount of the payment. Look up your 1099G1099INT To look up your 1099GINT youll need your adjusted gross income from your most recently filed Virginia income tax return Line 1 or the sum of both columns of Line 1 for a part-year return. If youd like to receive separate Form 1099 documents in the future you can call us at 1-800-TO-WELLS 1-800-869-3557 to make your request.

Check your account statements. Why is the interest on my Form 1098 more this year than it was last year. Online fillable Copies 1 B 2 and C.

This information is a general overview of Internal Revenue Service IRS Forms 1099-INT and 1098 and may not apply to your specific situation. Savings bonds or Treasury notes bills or bonds. For whom you withheld and paid any foreign tax on interest.

This 1099-G does not include any information on unemployment benefits received last year. To whom you paid amounts reportable in boxes 1 3 and 8 of at least 10. The form will have your Social Security number or taxpayer identification number on it which means the.

We send these forms by mail when the amount of interest paid is more than 10. If those options dont work or you need help with something else feel free to reach out to our team by calling 844 244. You can complete these copies online for furnishing statements to.

If you need a copy of your 1099-INT Write to. All copies of Form 1099-INT are available on the IRS website. This form reports your Coverdell ESA contributions.

Visit the TD Bank tax resource center. Contact the banking institutions corporate office or a local branch operating in your area and ask to have the 1099-INT form sent to your mailing address. There are many varieties including 1099-INT for interest 1099-DIV for dividends 1099-G for tax refunds 1099-R for pensions and 1099-MISC for.

Box 2 reports interest penalties youre charged for withdrawing money from an account before the maturity date. This form reports certain income paid from US. To ease statement furnishing requirements Copies 1 B 2 and C are fillable online in a PDF format available at IRSgovForm1099INT and IRSgovForm1099OID.

If you lost this information please contact us. If you would like to request a Form 1099-INT or Form 1098 from the previous tax years please visit your local TD Bank or call us at 1-888-751-9000. To get your interest earnings amounts do one of these.

Provide the bank with any account or identity information. Call the organization that holds your money. A Wage and Income Transcript from the IRS will have the information from all 1099-INT forms that were issued to you but in a different.

Sources to a nonresident alien except gross proceeds from sales. May include IRS Forms 1099-DIV 1099-INT 1099-MISC 1099-B and 1099-OID depending on your situation. If you dont remember your account number youll be able to find this by logging in to the Chime app and going to your Settings.

Youll find your account number in the Account Information section. If you did not receive a 1099-INT form from your financial institution there are a few steps you can perform to obtain the form.

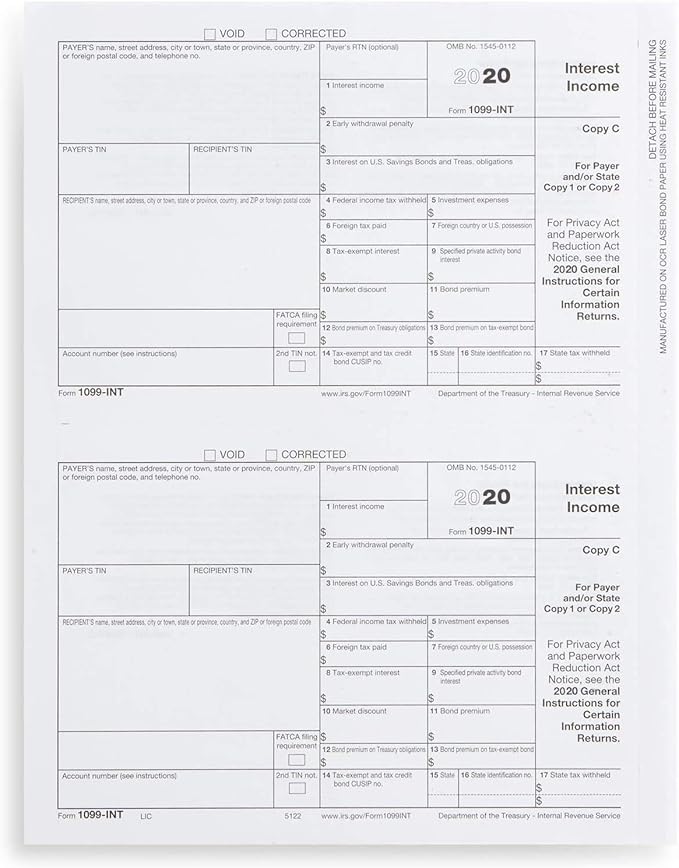

1099 Int Form 2 Part Mag Media Self Mailer Discount Tax Forms

1099 Int Form 2 Part Mag Media Self Mailer Discount Tax Forms

1099 Int Form Fillable Printable Download Free 2020 Instructions

1099 Int Form Fillable Printable Download Free 2020 Instructions

/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png) Form 1099 Oid Original Issue Discount Definition

Form 1099 Oid Original Issue Discount Definition

1099 Int Form 4 Part Carbonless Discount Tax Forms

1099 Int Form 4 Part Carbonless Discount Tax Forms

Interest Income Form 1099 Int What Is It Do You Need It

Interest Income Form 1099 Int What Is It Do You Need It

2021 Form Irs 1099 Int Fill Online Printable Fillable Blank Pdffiller

2021 Form Irs 1099 Int Fill Online Printable Fillable Blank Pdffiller

Missing An Irs Form 1099 Don T Ask For It

Missing An Irs Form 1099 Don T Ask For It

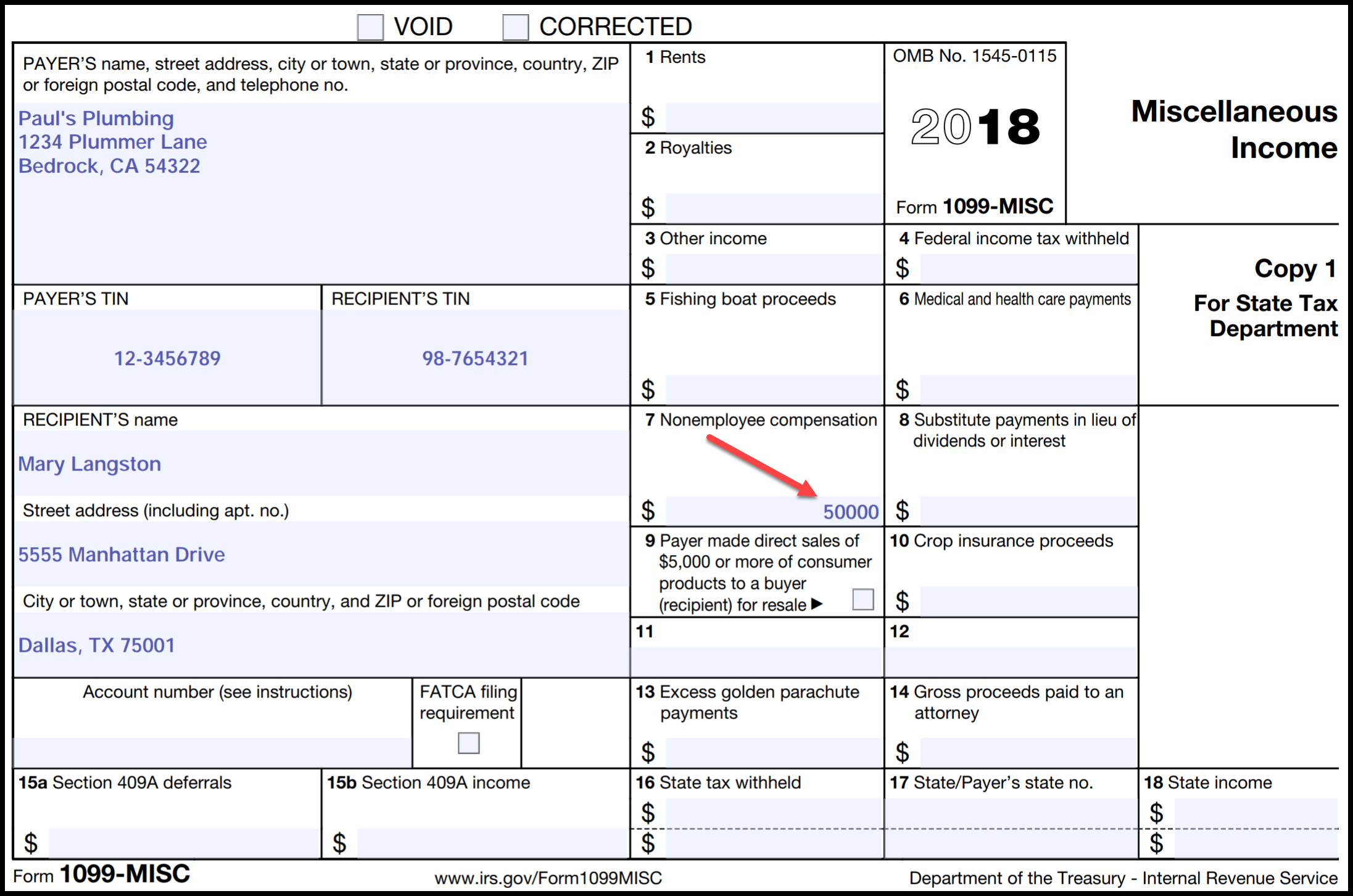

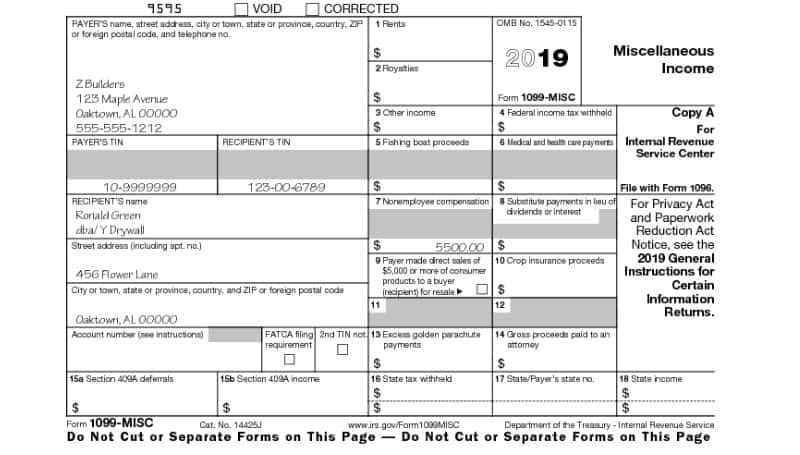

Understanding 1099 Form Samples

Understanding 1099 Form Samples

What Is A 1099 Int Tax Form How Do I File It

What Is A 1099 Int Tax Form How Do I File It

Interest Income Form 1099 Int What Is It Do You Need It

Interest Income Form 1099 Int What Is It Do You Need It

Schwab Moneywise Calculators Tools Understanding Form 1099

Schwab Moneywise Calculators Tools Understanding Form 1099

How To Read Your 1099 Robinhood

How To Read Your 1099 Robinhood

1099 Int Form Copy B Recipient Zbp Forms

1099 Int Form Copy B Recipient Zbp Forms

Amazon Com 1099 Int Tax Forms 2020 Interest Income Set 25 Pack Great For Quickbooks And Accounting Software 1099 Int 2020 Office Products

Amazon Com 1099 Int Tax Forms 2020 Interest Income Set 25 Pack Great For Quickbooks And Accounting Software 1099 Int 2020 Office Products