How To Add Form 1099 G On H&r Block

Your state tax refund is not considered income. I have an issue with HR Block but havent given any details yet.

:max_bytes(150000):strip_icc()/Clipboard01-2532a46ce39343d1a6ed73cecce80ae1.jpg) Form 1099 B Proceeds From Broker And Barter Exchange Definition

Form 1099 B Proceeds From Broker And Barter Exchange Definition

How to enter info re Form 1099-Q for 2020.

How to add form 1099 g on h&r block. If you receive a Form 1099-G and. I cant find where to put it in their online program. Nothing in boxes 5 and 6 but a 1 in box 7 distribution code.

Specific Instructions for Form 1099-R. Click on Go To. After adding your 1099-G form.

Second Home Taxes. Most Forms 1099-G are received for unemployment compensation or from state or local income tax refunds. If you are filing with HR Block here is how to make sure your unemployment tax waiver is correctly applied to your filing.

Thats also the amount for box 2 taxable amount. No - Answered by a verified Tech Support Rep. As mentioned earlier in the HR Block window to sign-in to TDA instead of ID PW in the ID field you must enter your TDA account number omit the dash mark and for PW you must enter the document ID from your TDA 1099 which is not available until late February.

Worried your taxes are too complex for HR Block Free Online. Type Betterment in the Financial Institution field and click Next to import your data. I have a 1099-R form for 2016.

HR Block doesnt say anything about the foreign tax paid or needing a Form 1116 after you enter the 1099-DIV. Scroll down and find IRA and Pension Income Form 1099-R. How do I report the 1099-R on HR Block.

Just continue with your other entries. If you itemized your deductions in the prior tax year the state tax refund you received will be considered as income for this tax year. Click the Id like to see all federal forms link to find a list of federal tax forms.

HR Block Online and HR Block Software get unlimited sessions of live personal tax advice with a tax professional with Online Assist and Software Assist for a fee. More from HR Block. Scroll down to the Search for federal forms search box and enter 1099 in the box.

In box 1 my gross distribution is 724319. Click on Import 1099-R if youd like. Nothing in box 3 and 144864 in box 4.

Look under income tab there should be a link for 1099s it is a seperate link then W2s. I show manual entries with Enter Manually here. If youre entering the 1099-DIV manually type the numbers as shown on your form.

You can include your Form 1099-G for free with HR Block Online Free. Check out Blocks other ways to file. Does anyone know how I can enter Box 6 of form 1099-G into HR Blocks online free edition.

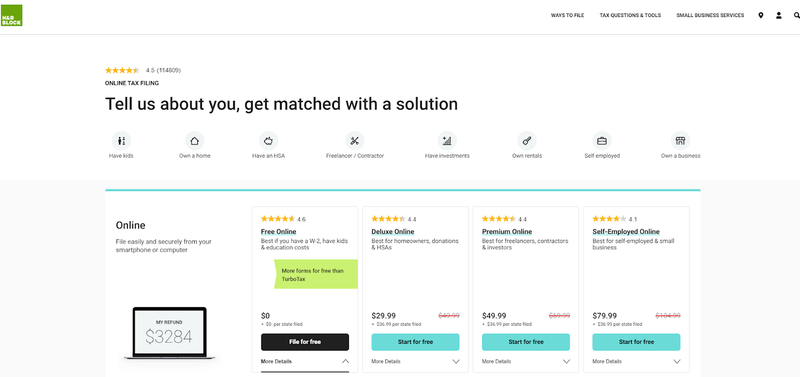

Retirement income Real estate Investments Wages Related Resources. Click Next and on the following page click Add New 1099 the exact text will differ for 1099-R 1099-B and 1099-DIV. In this video Im going to show you how to file tax online for free using HR Block websiteFirst of all go to the HR Block website you will find the link.

View the list of 1099 forms below the search box and click the Add form button next to the form name you have. Free tax filing with unemployment income. If you import double-check the import to make sure all the numbers match your downloaded copy.

Learn what a 1099 IRS tax form is and the different types of 1099 forms with the experts at HR Block. Success uploading TD Ameritrade to HR Block Deluxe E-file State. Desktop Version of HR Block.

Thats pretty much it. Standard live chat hours apply 700 am. File Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from profit-sharing or retirement plans any individual retirement arrangements IRAs annuities.

Find out if you will receive 1099 forms from employers or investment companies.

Form 1099 Requirements For Foreign Workers A Klr Global Tax Blog Article Blog Article Worker Quickbooks

Form 1099 Requirements For Foreign Workers A Klr Global Tax Blog Article Blog Article Worker Quickbooks

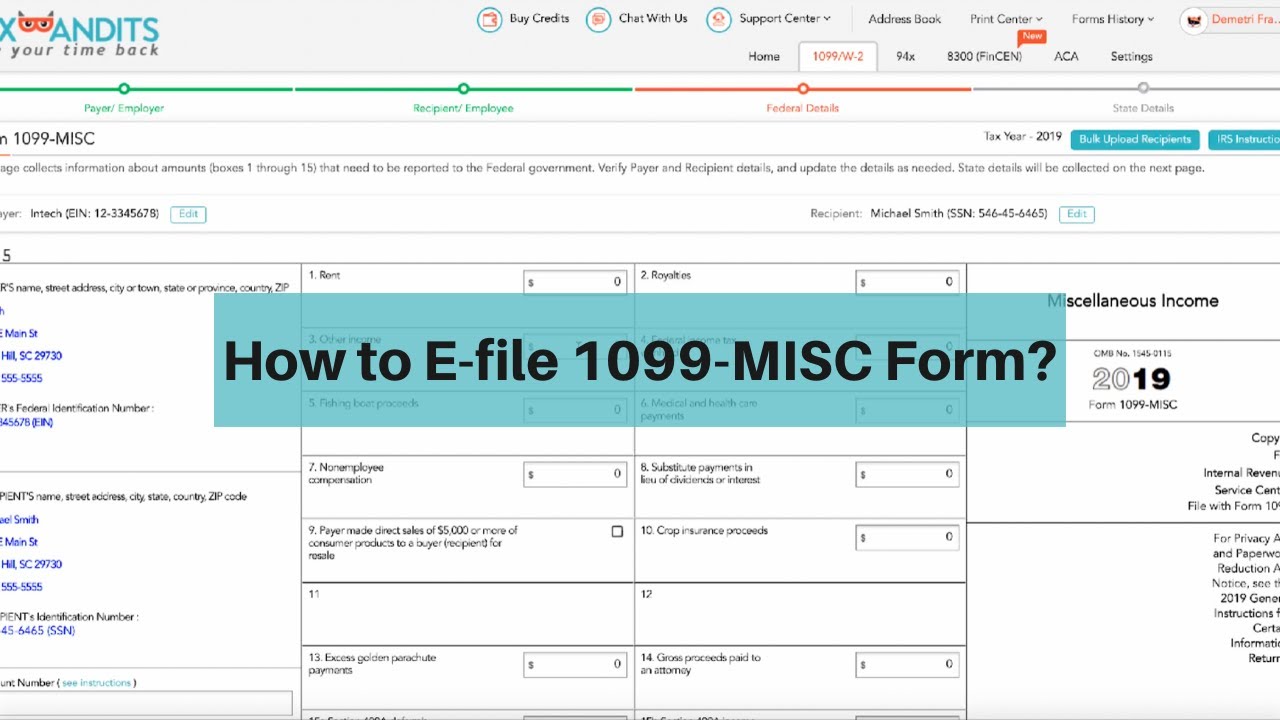

How To File Form 1099 Misc Online For 2019 Tax Year Youtube

How To File Form 1099 Misc Online For 2019 Tax Year Youtube

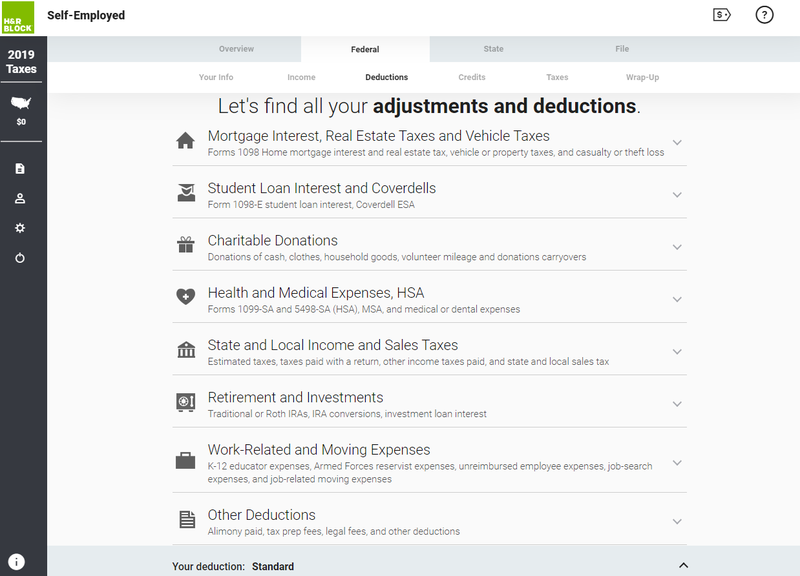

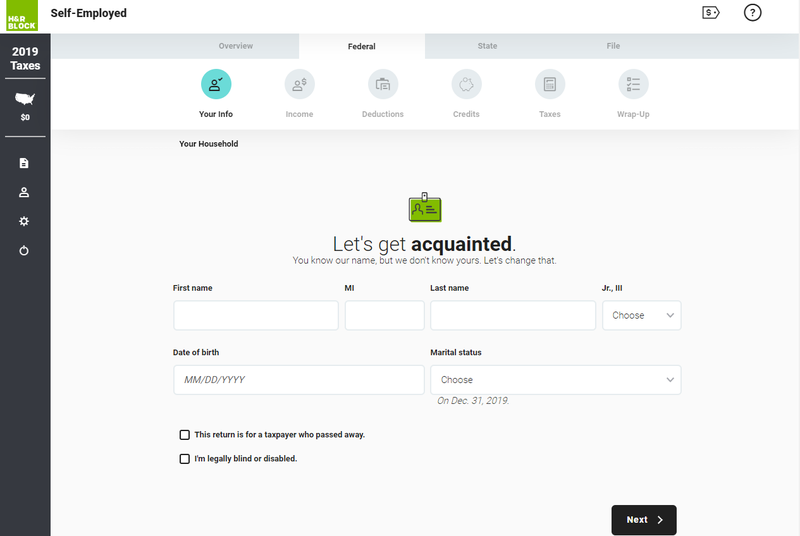

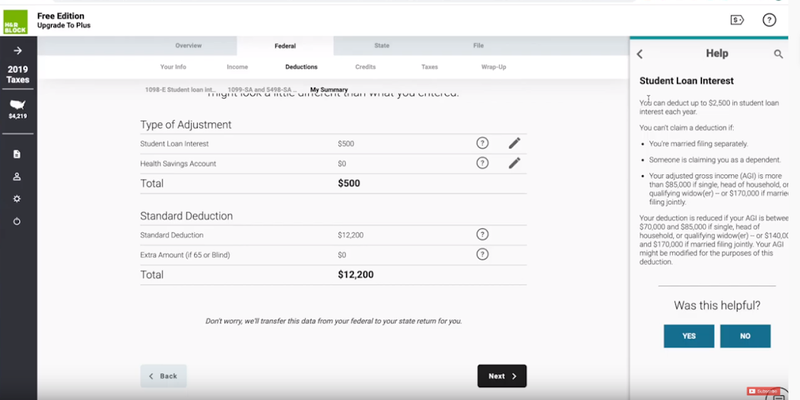

H R Block Online Review 2021 Features Pricing More The Blueprint

H R Block Online Review 2021 Features Pricing More The Blueprint

How To Report Backdoor Roth In H R Block Tax Software A Walkthrough

How To Report Backdoor Roth In H R Block Tax Software A Walkthrough

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

E File Form 1099 With Your 2020 2021 Online Tax Return

E File Form 1099 With Your 2020 2021 Online Tax Return

H R Block Online Review 2021 Features Pricing More The Blueprint

H R Block Online Review 2021 Features Pricing More The Blueprint

H R Block Online Review 2021 Features Pricing More The Blueprint

H R Block Online Review 2021 Features Pricing More The Blueprint

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

H R Block Online Tax Filing Review

H R Block Online Tax Filing Review

/ScreenShot2020-02-03at12.11.14PM-13bca5b544274295ba7589b5618201fb.png) Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

Form 1099 Patr Taxable Distributions Received From Cooperatives Definition

E File Form 1099 With Your 2020 2021 Online Tax Return

E File Form 1099 With Your 2020 2021 Online Tax Return

E File Form 1099 With Your 2020 2021 Online Tax Return

E File Form 1099 With Your 2020 2021 Online Tax Return

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

H R Block Online Review 2021 Features Pricing More The Blueprint

H R Block Online Review 2021 Features Pricing More The Blueprint

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube