How Much Tax Does A Sole Proprietor Pay In South Africa

If youre new to the world of being self-employed you might be confused at the difference between a sole proprietorship and a company. A sole proprietor can also do business under a trade name such as Janes Jet Skis or.

Tax Tables 2020 2021 Know Your Tax Brackets Quickbooks

Tax Tables 2020 2021 Know Your Tax Brackets Quickbooks

Income tax normal tax is levied at.

How much tax does a sole proprietor pay in south africa. Sole Proprietorship Sole Proprietor. The cornerstone of tax law is this. 124 goes t0ward Social Security tax on up to the first 132900 of your income.

Rates of income individuals 2010 R0 R132 000. Basically the taxable income of the company or close corporation is determined in the same way as that of a sole proprietorship or partnership see diagram 1 diagram 2. R132 001 R210 000.

A sole proprietor is someone who owns an unincorporated business by himself or herself. This is his taxable business income. However keep in mind that expenses are purely an estimation under the tax turnover system.

Lets do a worked example of the difference this makes on R100000 profit between a registered company and a sole proprietors tax position. This is so SARS can accurately determine how much you need to pay in taxes at year-end. One can only claim a deduction for an expense that was actually incurred in the production of income and that is not of a capital nature.

Heres how the self-employment taxbreaks down for 2019. For example as Jane Jones. The corporate tax rate in South Africa is a flat rate of 28 for all companies 27 from 1 April 2022.

If you are a sole proprietor use the information in the chart below to help you determine some of the forms that you may be required to file. He completes his Schedule C which shows a net business income as 10000. If youre a sole proprietor whos completely self-employed youre responsible for paying this sole proprietor tax yourself.

You can do this under your own name or under a trading name. Unlike natural persons a company or close corporation pays tax at flat rate 35 tax 125 STC on its taxable income for the year of. As a sole trader your tax brackets will be the same as.

Turnover tax minimum amount of taxable income. Taxes for sole proprietors are levied on the owners personal income tax. This guide is a general guide dealing with the taxation of small businesses such as sole proprietors partnerships and companies not part of large groups.

In addition dividends tax is levied at 15 on profits retained in the company and distributed as a dividend in the future. For many small business owners there are advantages to opting for turnover tax over the standard small business tax. This is slightly below the average corporate tax rate for Africa overall which is 2845 and above the global average of 2418.

This means that you will be required to submit provisional estimated returns by 31 August and 28 February of each tax year. The owner of a Sole Proprietorship will have to estimate the amount of profit that heshe will make. He must pay self-employment tax of 153 on this income or 1530.

However if you are the sole member of a domestic limited liability company LLC you are not a sole proprietor if you elect to treat the LLC as a corporation. Terry is a sole proprietor a single tax filer. In summary as a sole proprietor one needs to file an ITR12 annually and 2 IRP6s provisional tax.

18 of each R1. Theres a secondary rebate for those over 65 years and a tertiary rebate for those over 75 years. In addition dividends tax is levied at 20 on profits retained in the company and distributed as a dividend in the future.

However trusts excluding special trusts in South Africa pay tax at a separate rate of 45. A sole proprietor or each partner in the case of a partnership is subject to income tax on his or her taxable income. In a company profits are taxed at a rate of 28 irrespective of value.

Income Tax Rates for Individuals. This means that the owner pays provisional tax to SARS. In a company profits are taxed at a rate of 28 irrespective of value.

The Sole Proprietorship is the simplest and most common form of business conducted by a single individual owner the Sole ProprietorSole Proprietorship can conduct business under their own name by simply doing business. After making estimates heshe will have to pay the first and second provisional tax payments to SARS. 29 April 2016 at 1124 As a sole proprietor you are taxed in your personal capacity.

Now that we know the terms and definition and have discussed the importance of checking your own BIR Form 2303 Tax Types let us now discuss the type of taxes applicable to sole proprietors freelancers self-employed independent contractor and professional. Some of the discussions in this guide could however be applicable to any type of taxpayer. Your business income from your sole proprietor is added to the other income you earn and then the total income is taxed per the normal tax tables for individuals.

The aim is to discuss the typical taxation issues of an average business trading in South Africa. Business start-ups and registering for provisional tax As a sole proprietor you are required to register as a provisional taxpayer with SARS in the tax year in which you start your business advises Burman.

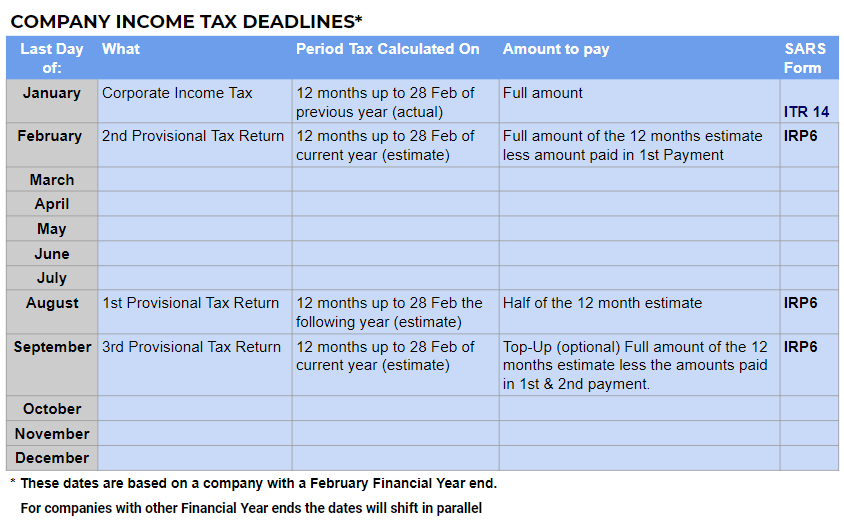

A Guide To Business Income Tax In Sa All Info Including Tax Return Deadlines And Sars Forms

A Guide To Business Income Tax In Sa All Info Including Tax Return Deadlines And Sars Forms

Service Tax Registration Online India In 2020 Business Owner Business Expense Tax Payment

Service Tax Registration Online India In 2020 Business Owner Business Expense Tax Payment

Corporate Tax In South Africa A Guide For Expats Expatica

Corporate Tax In South Africa A Guide For Expats Expatica

This Is Who Pays Taxes In South Africa

This Is Who Pays Taxes In South Africa

Sars Tax Deductible Business Expenses Listed Deductions

Sars Tax Deductible Business Expenses Listed Deductions

7 Genius Functions On The Fnb Mobile App Banking App Mobile App Mobile Banking

7 Genius Functions On The Fnb Mobile App Banking App Mobile App Mobile Banking

Cc Restoration 0713483407 Johannesburg Cbd Gumtree South Africa 144893105 Business Finance Financial Services Bookkeeping Business

Cc Restoration 0713483407 Johannesburg Cbd Gumtree South Africa 144893105 Business Finance Financial Services Bookkeeping Business

Business Tax Rates In South Africa

Business Tax Rates In South Africa

Corporate Tax In South Africa A Guide For Expats Expatica

Corporate Tax In South Africa A Guide For Expats Expatica

Corporate Tax In South Africa A Guide For Expats Expatica

Corporate Tax In South Africa A Guide For Expats Expatica

What Is The Minimum Amount To File Taxes South Africa Small Business Centre

What Is The Minimum Amount To File Taxes South Africa Small Business Centre

A Guide For South Africans On How Futures Contract Work Futures Contract Crude Oil Futures Contract

A Guide For South Africans On How Futures Contract Work Futures Contract Crude Oil Futures Contract

How To Calculate Income Tax South Africa 2018 Youtube

How To Calculate Income Tax South Africa 2018 Youtube

This Is Who Pays Taxes In South Africa

This Is Who Pays Taxes In South Africa

Tax On South Africa Casino Wins Blog Taxes Casino Paying Taxes

Tax On South Africa Casino Wins Blog Taxes Casino Paying Taxes

Corporate Tax In South Africa A Guide For Expats Expatica

Corporate Tax In South Africa A Guide For Expats Expatica

Accountants For Trust Attorney Accounts City Centre Gumtree South Africa 121551344 Legal Services Trust Financial Advisors

Accountants For Trust Attorney Accounts City Centre Gumtree South Africa 121551344 Legal Services Trust Financial Advisors

Tax Guide For Small Business Structures In Sa Open By Yoco

Tax Guide For Small Business Structures In Sa Open By Yoco

Five Main Characterstics Of Sole Proprietorship Sole Proprietorship Affiliate Marketing Business Business Loans

Five Main Characterstics Of Sole Proprietorship Sole Proprietorship Affiliate Marketing Business Business Loans