Does A Sole Proprietor Need A Resale Certificate

Your business may need to obtain business licenses or professional licenses depending on its business activities. A sole proprietorship is the most basic type of business to establish.

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

Every five years you must renew your assumed name certificate.

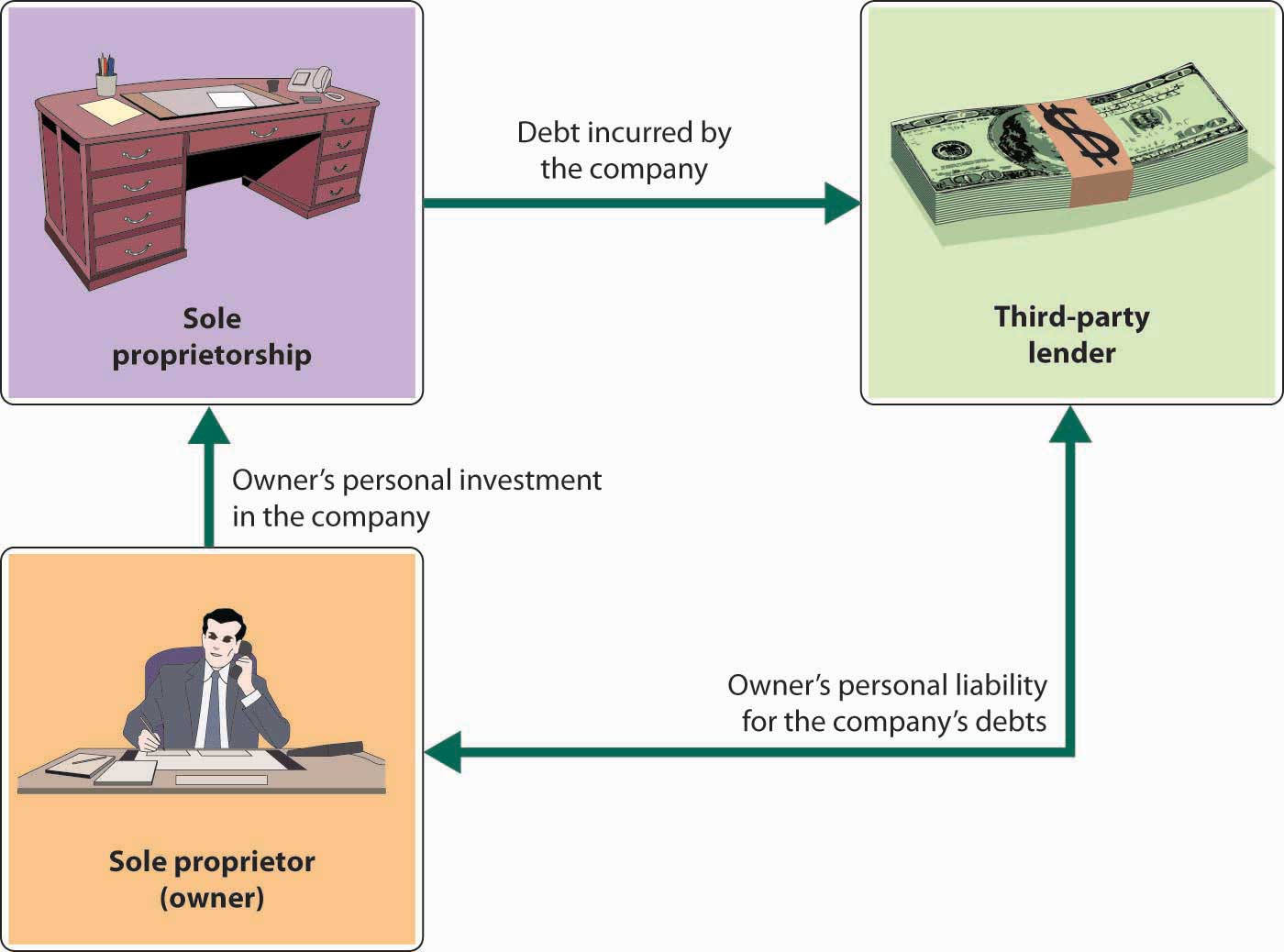

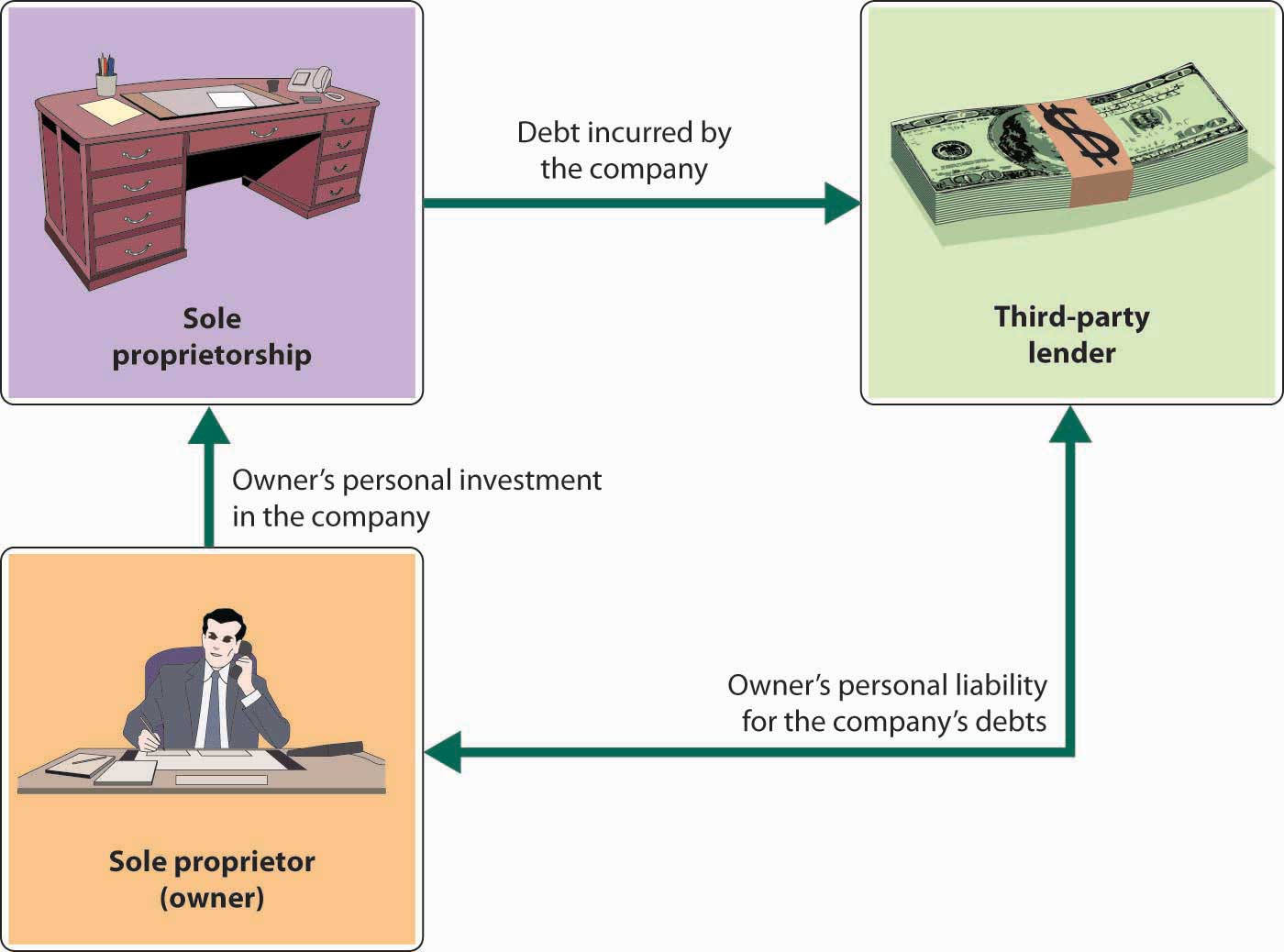

Does a sole proprietor need a resale certificate. Owner reports profit or loss on his or her personal tax return. The owner is liable for all business operations. A sole proprietorship is not a separate legal entity - it is merely an individual conducting business - thus there is no formation document.

Your business may need to obtain business licenses or professional licenses depending on its business activities. In fact you may already own one without knowing it. Michigan provides a comprehensive website of every profession and occupation that requires a license by any sole proprietorship.

In the startup of a new online business Etsy for example with the intent to purchase goods many of which will be modified and resold. A sole proprietor can be a self-employed individual or an independent contractor. Simple and inexpensive to create and operate.

A sole proprietor using something other than their own full name for the business will have to show the bank an ownership certificate. A sole proprietor must register with the state taxing authority to obtain the appropriate permit or. The filing fee varies from location to location.

The certificate must be notarized prior to filing with the clerks office. While every state has its own rules and regulations they all require businesses to carry a sales tax certificate. In most cases they will be able to get a credit for the sales taxes paid later on their sales tax filing.

Obtain Licenses Permits and Zoning Clearance. Sellers are not required to accept resale certificates however most do. You alone own the company and are responsible for its assets and liabilities.

Every four years you must renew your business certificate. Yes for sole proprietorship if you sell merchandise crafts you need a sales tax ID also called a sellers permit. The permit is obtained from a government office at either the state or local level where the.

Second Sole ProprietorshipMotorcycle Resale in FL the wholesale ID can be used to buy in large amounts of merchandise food or other tangible items and add the sales tax to the price so you can remit it to the. This document is obtained from the county clerk where the. Selling goods and services requires collecting sales tax in those states that impose a sales tax.

Who Needs This Certificate. Forming a Sole Proprietorship. You will give a completed Exemption Certificate to each supplier when you buy goods and services for resale or other exempt purposes.

Items for your own use paper ink office equipment are still taxable. A certificate of incorporation applies only to a corporation. Of course as a salon business you need a DBA LLC or corporation as well as a.

If you use a trade name you will likely need a Certificate of Assumed Name. The way that works is after you get the sellers permit you use the resale certificate that comes with the permit to fax or email a sign copy to the wholesaler and then you can buy wholesale because the wholesaler will not sell you merchandise without the resale certificate. If you are selling or planning to sell physical merchandise whether you business is a corporation an LLC or a private company you must have and keep current a.

You avoid that by obtaining a business license and resellers certificate in your home state and that only entitles you to not pay sales tax on items you buy specifically for resale. No a sole proprietorship does not need a certificate of incorporation. First Sole Proprietorship business entity formation.

Partnerships are required to register the partnership name with a DBA assumed name LLC or corporation and get a partnership EIN. Sole Proprietor A sole proprietorship is a business that has only one owner and is not incorporated or registered with the state as a limited liability company LLC. Sole proprietors self-employed individuals report all business income and expenses on their.

Im guessing your answer is a big fat Nope No one does which is why if youre going to get into the retail business you need a resellers permit also called a resale license resellers license resale certificate or resellers certificate sales tax permit or sales tax ID. You do not have to take any formal action to form a sole proprietorship. If you are a freelance writer for example you are a sole proprietor.

This rule differs for sole proprietorships and general partnerships. Obtain Licenses Permits and Zoning Clearance. Similarly you will also need to obtain exemption certificates from your customers when they purchase goods or services from you for resale or other exempt purposes.

Massachusetts provides a comprehensive website of every profession and occupation that requires a license by any sole proprietorship. A sole proprietorship is a business run by an executive owner. If so should the SS-4 be filed under the individual or business name.

You dont have to file special forms or pay fees to start your business. If youre a US-based seller you dont need to pay sales tax out of your own pocket for the products youre reselling to others. If the vendor doesnt accept the certificate the buyer will have to pay sales tax on the merchandise being purchased.

As long as you are the only owner this status automatically comes from your business activities. In general a sole proprietor must obtain a permit to buy or sell product whether retail or wholesale. Can a sole proprietor obtain a resale license.

A Seller S Permit Allows A State To Identify A Business As A Collector Of Sales Tax Some States May Call Thi Creative Education Black Girl Art Sole Proprietor

A Seller S Permit Allows A State To Identify A Business As A Collector Of Sales Tax Some States May Call Thi Creative Education Black Girl Art Sole Proprietor

Ebay Resellers Sole Proprietorships

Ebay Resellers Sole Proprietorships

Selecting A Form Of Business Ownership

Selecting A Form Of Business Ownership

How To Change From A Sole Proprietor To An Llc

How To Change From A Sole Proprietor To An Llc

Https Business Oksbdc Org Documentmaster Aspx Doc 1866

How Much Investment Is Needed To Start A Sole Manufacturing Company Quora

General Form Of Agreement For Sale Of Business By Sole Proprietor Asset Purchase Agreement Template Download From Accounting And Finance Agreements

General Form Of Agreement For Sale Of Business By Sole Proprietor Asset Purchase Agreement Template Download From Accounting And Finance Agreements

Business Entity Comparison Chart S Corporation Sole Proprietorship General Partnership

Business Entity Comparison Chart S Corporation Sole Proprietorship General Partnership

Sole Proprietorships Advantages Disadvantages Piktochart Infographic Teaching Business Business Basics Sole Proprietorship

Sole Proprietorships Advantages Disadvantages Piktochart Infographic Teaching Business Business Basics Sole Proprietorship

What Is A Sole Proprietorship Steps To Starting A Business

What Is A Sole Proprietorship Steps To Starting A Business

Browse Our Image Of Sole Proprietor Profit And Loss Statement Template For Free Profit And Loss Statement Statement Template Sole Proprietor

Browse Our Image Of Sole Proprietor Profit And Loss Statement Template For Free Profit And Loss Statement Statement Template Sole Proprietor

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

Independent Contractor Vs Sole Proprietor What Are The Differences Between The Two

Independent Contractor Vs Sole Proprietor What Are The Differences Between The Two

Look Into Our Dealer Program From Strongpoles Toll Free 844 669 3537 Or Strongpoles Com Company Names Zip Code Sheet Music

Look Into Our Dealer Program From Strongpoles Toll Free 844 669 3537 Or Strongpoles Com Company Names Zip Code Sheet Music

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

Do You Understand The 1099 Misc Ageras Irs Taxes Irs Tax Forms Tax Tricks

Do You Understand The 1099 Misc Ageras Irs Taxes Irs Tax Forms Tax Tricks

Should You Run Your One Person Business As A Sole Proprietorship Epw Small Business Law Pc Sole Proprietorship Business Law Small Business Law

Should You Run Your One Person Business As A Sole Proprietorship Epw Small Business Law Pc Sole Proprietorship Business Law Small Business Law

Get Our Example Of Sole Proprietor Profit And Loss Statement Template For Free Profit And Loss Statement Statement Template Sole Proprietor

Get Our Example Of Sole Proprietor Profit And Loss Statement Template For Free Profit And Loss Statement Statement Template Sole Proprietor

6 Steps For Switching From A Sole Proprietorship To Llc

6 Steps For Switching From A Sole Proprietorship To Llc