Do 1099 Workers Qualify For Sba Loan

Paying workers with a 1099 is NOT having employees. The most common businesses that get SBA loans play a major role in the economy and employ many workers in the US.

Contractor Contract Sample Free Printable Documents Contractor Contract Contract Template Contractors

Contractor Contract Sample Free Printable Documents Contractor Contract Contract Template Contractors

The early information released by the Small Business Administration created a lot of confusion on this topic.

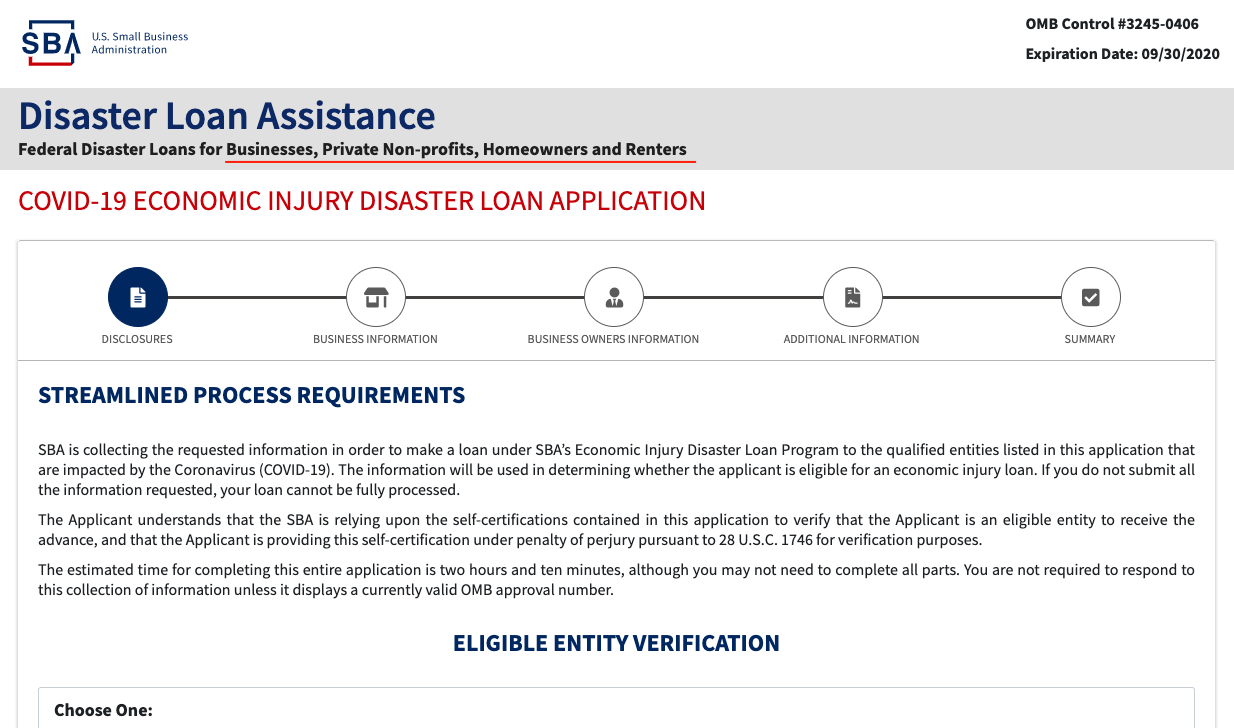

Do 1099 workers qualify for sba loan. When you do apply for an SBA loan what matters most is. 8 the SBA notified lenders and loan intermediaries to send a 1099-MISC form to any borrowers for the amount forgiven for principal interest and fees. SBA PPP Loan Information for Non-profit Organizations 1 SBA Application.

The SBA posted a sample application for seeking a PPP loan along with instructions for completing and submitting the applicationThe application may not be submitted to banks until this Friday April 3However given that loans will be given on a first come first served basis until the funds are spent it is important. Yes 1099 employees and self-employed individuals are eligible to apply for PPP loan forgiveness. Several people have asked how the Paycheck Protection Program forgivable loans sometimes referred to as grants created by the CARES Act apply to 1099 independent contractors.

But to be approved a business must meet standards that vary based on the lender and the type of loan. As per the PPP legislation the maximum payroll amount for any one individual that can be used to calculate a loan size is 100000 on an annualized basis. An SBA-backed loan that helps businesses keep their workforce employed during the COVID-19 crisis.

Independent contractors receiving 1099-MISC forms and self-employed individuals are eligible to apply for these potentially 100 forgivable loans beginning on Jan 11 2021. The reason for this is that independent contractors are self-employed and thus can apply for their own PPP loans as of April 10 2020 to cover the pay they would have received and other expenses. Those who previously received a First Draw PPP Loan and will or has used the full amount only for authorized uses.

Check out all the answers from our credit card experts. The issue regarding 1099 workers had been one of. Even if you havent filed your taxes for 2020 you can still complete and attest to your 1040 Schedule C and qualify.

There has been a tremendous amount of frustration by small business owners operating. Posted on May 31 2016 by Steven Koprince. Independent contractors--who file their taxes using 1099 forms--have the ability to apply for their own PPP loans beginning April 10.

If they determine that you may qualify for a PPP loan they will assist you with putting together your PPP Loan application and then submit it to a lender in their network that make be offering PPP loans at that time. Our partner will review this initial request. It does not pertain to loan size calculations.

You should let your contractors and other 1099 workers know that they can and should apply directly with Womply for their own PPP loans. Ask Elaine a question. Theres absolutely no reason not to apply for a PPP loan if you have over 4800 in annual income on a 10991040 Schedule C and you were in business before February 15 2020.

Learn about the employment law FLSA Fair Labor Standards Act and some of the criteria to take into consideration when classifying a worker as an Independent Contractor1099 Salaried or Hourly employee. This indicates the government is counting the forgiven amount as income to the borrowers. Small businesses that have trouble qualifying for financing can seek help from the US.

A 1099 independent contractor is a subcontractornot an employee. What You Need to Know About 1099 Workers for SBA Relief Blog New guidance clarifies that independent contractors do not count toward a businesss payroll in the Paycheck Protection Programs small-business loans. Do you have employees.

You need to either have employees who receive a salary or 1099 employees who you pay in order to qualify for the loan. This guidance comes from the SBAs major new rule on the limitations on subcontracting in which the SBA responded to public questions about how independent contractors are to be treated. Lendio strives to provide you with the most current information as it relates to the Paycheck Protection Program related SBA programs and relevant.

But self-employed individuals will calculate the amount of the PPP loan and the amount of forgiveness differently from other business types. Its free to apply and it could mean thousands of dollars in. Treasury guidance regarding 1099 employees pertains to eligibility.

Getting an SBA loan. In order for a sole proprietor to properly apply. Factors that lenders weigh when determining whether your small business qualifies for an SBA loan range from your credit score to the length of time youve been in.

How Do I Become An Independent Contractor Management Guru How To Memorize Things Business Management Independent Contractor

How Do I Become An Independent Contractor Management Guru How To Memorize Things Business Management Independent Contractor

Filing Form 1099 Misc For Your Independent Contractors Small Business Tax Small Business Tax Deductions Filing Taxes

Filing Form 1099 Misc For Your Independent Contractors Small Business Tax Small Business Tax Deductions Filing Taxes

Sba Eidl Loan For Small Business Application Up To 150k Youtube

Sba Eidl Loan For Small Business Application Up To 150k Youtube

Contractor Vs Employee Risks And Rewards Infographic Via Wunderland Group Employee Infographic Independent Contractor Contractors

Contractor Vs Employee Risks And Rewards Infographic Via Wunderland Group Employee Infographic Independent Contractor Contractors

Sba Disaster Loans And Emergency Grants Artist S Edition What You Need To Know

Sba Disaster Loans And Emergency Grants Artist S Edition What You Need To Know

Free 1099 Pay Stub Template Inspirational Pay Stub 1099 Letter Examples Generator For Worker Letter Example Business Case Template Free Business Card Templates

Free 1099 Pay Stub Template Inspirational Pay Stub 1099 Letter Examples Generator For Worker Letter Example Business Case Template Free Business Card Templates

Https Www Sba Gov Sites Default Files Articles Eidl And P3 4 14 2020 10 Am Pdf

How To Apply For The 1099 Ppp Loan

How To Apply For The 1099 Ppp Loan

Music Advocacy Organizations Have Created A Website To Provide Guidance Around The Cares Act It Wil Small Business Resources Business Benefits Emergency Loans

Music Advocacy Organizations Have Created A Website To Provide Guidance Around The Cares Act It Wil Small Business Resources Business Benefits Emergency Loans

Iou Financial Review Small Business Loans Small Business Loans Business Loans Financial

Iou Financial Review Small Business Loans Small Business Loans Business Loans Financial

Here Is A Tip To Speed Up Your Sba Payprotectionprogram Loan Process Prepare All 2019 Employee And Con Small Business Loans Business Tips Business Loans

Here Is A Tip To Speed Up Your Sba Payprotectionprogram Loan Process Prepare All 2019 Employee And Con Small Business Loans Business Tips Business Loans

Everything You Need To Know To Apply For An Sba Express Loan Profit And Loss Statement How To Apply Expressions

Everything You Need To Know To Apply For An Sba Express Loan Profit And Loss Statement How To Apply Expressions

Pin On Small Business And Independent Contractors

Pin On Small Business And Independent Contractors

How To Apply For The Sba Payroll Protection Program Loan Simple Guide

How To Apply For The Sba Payroll Protection Program Loan Simple Guide

Https Www Sba Gov Sites Default Files Resource Files Covid 19 2 Choices With Ppp April 16 Ver 1 Pdf

1099 Nec Tax Services Accounting Firms Accounting Services

1099 Nec Tax Services Accounting Firms Accounting Services

How To Apply For Sba Disaster Loan Application Step By Step Video For Self Employed Eidl Money Youtube

How To Apply For Sba Disaster Loan Application Step By Step Video For Self Employed Eidl Money Youtube