Canada Business Corporations Form 17

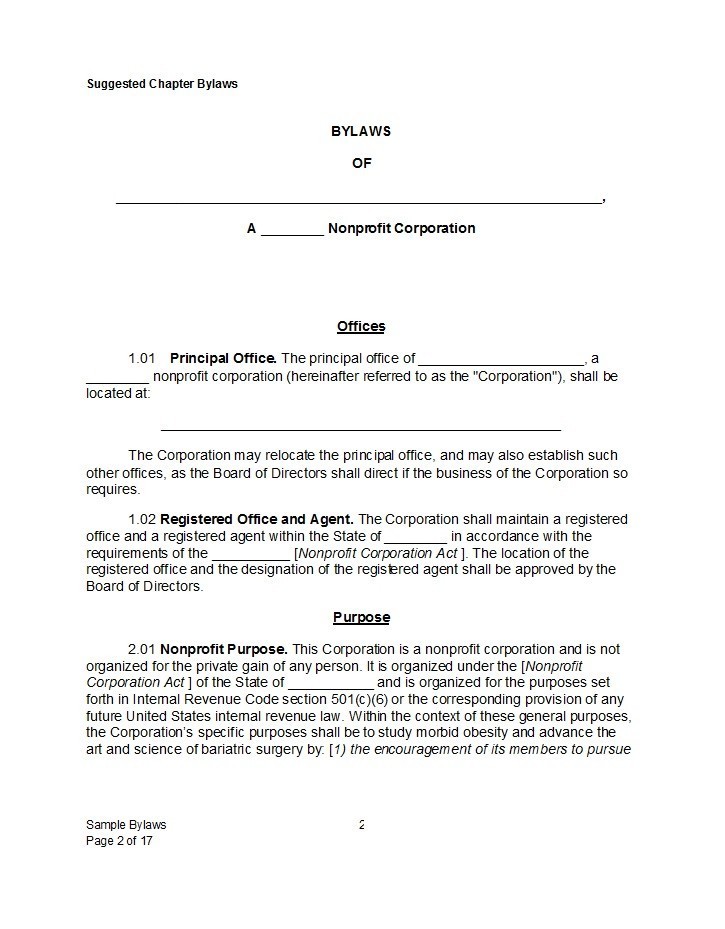

Same 3 No persons associated in partnership shall carry on business or identify themselves to the public unless the firm name of the partnership is registered by all of the. Her Excellency the Governor General in Council on the recommendation of the Minister of Industry pursuant to subsection 2611 a of the Canada Business Corporations Act b hereby makes the annexed Canada Business Corporations Regulations 2001.

This form serves as a federal provincial and territorial corporation income tax return unless the corporation is located in Quebec or Alberta.

Canada business corporations form 17. INFO 17 COM MAR 2018 4 IN THE MATTER OF insert full company name AND THE BRITISH COLUMBIA BUSINESS CORPORATIONS ACT SECTION 316 AFFIDAVIT I insert name of director of insert full residential address in the Province of British Columbia make oath and say as follows. B the province in Canada where the registered office is to be situated. PART XIV1 Disclosure Relating to Diversity.

Articles of incorporation 6 1 Articles of incorporation shall follow the form that the Director fixes and shall set out in respect of the proposed corporation a the name of the corporation. FORM 17 ARTICLES OF DISSOLUTION Item 4 Indicate if the corporation is applying for a dissolution under section 210 or 211 of the CBCA. B the province in Canada where the registered office is to be situated.

Bankruptcy does not end a corporations existence. Federal laws of canada. Revival 209 1 When a corporation or other body corporate is dissolved under this Part section 268 of this Act section 261 of the Canada Business Corporations Act chapter 33 of the Statutes of Canada 1974-75-76 or subsection 2976 of the Canada Not-for-profit Corporations Act any interested person may apply to the Director to have the.

You can assume your application is processing right up to 5 business days following your incorporation application and you dont need to contact us to confirm. Due to a high volume of requests applications are taking longer than usual to process. The mandate of the first directors begins on the date Corporations Canada issues the certificate of incorporation and ends at the first meeting of shareholders.

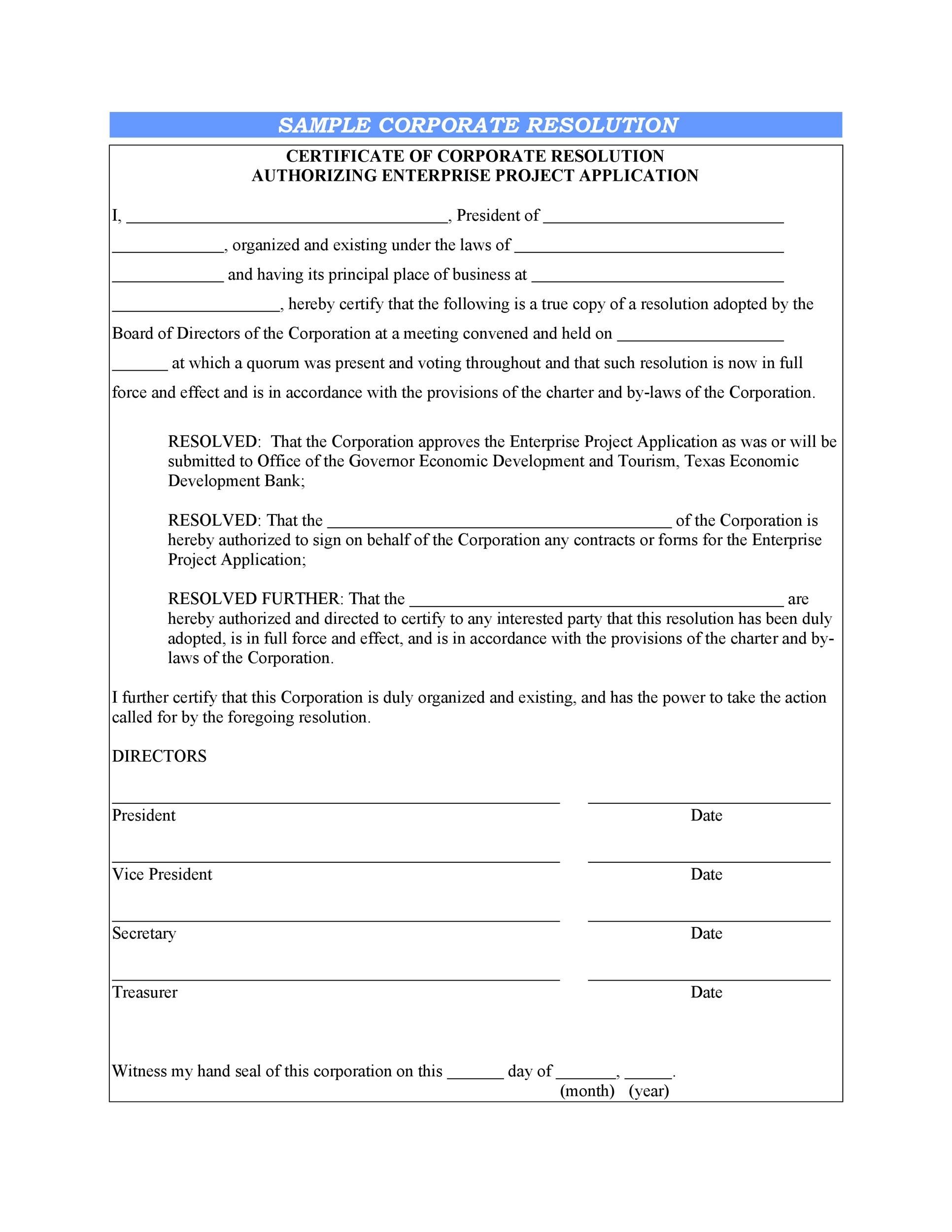

Articles of incorporation 6 1 Articles of incorporation shall follow the form that the Director fixes and shall set out in respect of the proposed corporation a the name of the corporation. This form lists the first members of the board of directors of your corporation. Forms policies models and legislation.

Check only one box. Guide on dissolving a business corporation. At that first meeting of shareholders the shareholders elect the corporations directors.

To receive the latest news on business corporations. If such is the case you have to file a. Paper forms may be used however to assist.

A corporation can apply to dissolve when it has no property or liabilities. Federal laws of canada. Benefit Companies can file online filings through the Business Registry.

Subsection 2101 of the CBCA applies to a corporation that has not issued any shares. Diversity in corporations 1721 1 The directors of a prescribed corporation shall place before the shareholders at every annual meeting the prescribed information respecting diversity among the directors and among the members of senior management as defined by regulation. Same 2 No individual shall carry on business or identify his or her business to the public under a name other than his or her own name unless the name is registered by that individual.

Canada Business Corporations Regulations 2001. Forms - For federal business corporations its faster and less expensive to file through Corporations Canadas Online Filing Centre. A bankrupt corporation cannot request to be dissolved under the Canada Business Corporations Act CBCA.

C the classes and any maximum number of shares that the corporation is authorized to. C the classes and any maximum number of shares that the corporation is authorized to issue and. Federal corporation forms and instructions On January 15 2020 Corporations Canada adopted a digital-first approach to forms for business and not-for-profit corporations.

The Canada Business Corporations Act allows businesses to incorporate federally and operate under one name right across the country. Annual returns Form 17 for all corporations are due by the end of the month following the anniversary date of incorporationamalgamation. Subsection 194 of the CBCA requires a corporation to send a Form 3 to Corporations Canada within 15 days of any change to its registered office address.

17 Subsections 1501. Do not mail forms to us unless the form indicates a paper copy should be submitted or you are instructed to do so by BC Registries staff. Subsection 2102 of the CBCA applies to a corporation that has no property and no liabilities.

Canada Business Corporations Act RSC 1985 c. Subsection 1131 of the CBCA requires a corporation to send a Form 6 to Corporations Canada within. Have your GSTHST refunds and rebates payroll andor corporation income tax refunds deposited directly into your bank account or change the direct deposit information.

Federal laws of canada. The exception is a bankrupt corporation. 150 1 A person shall not solicit proxies unless a proxy circular in the prescribed form is made available in the prescribed manner to the auditor of the corporation to each shareholder whose proxy is solicited.

Free Business Credit Application Application Form Job Application Form Credit Card Application

Free Business Credit Application Application Form Job Application Form Credit Card Application

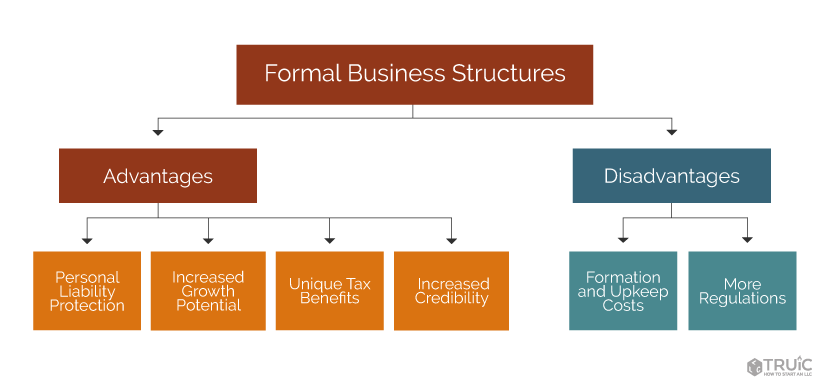

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic