What Is The Format Of Tin Number

Goods and Services Tax Identification Number GSTIN is a 15 digit number that is given in a certificate of registration to an applicant. The fourth and fifth digits always fall in the 70-88 90-92 and 94-99 ranges.

Tin Ssn Ein And Itin Taxpayer Id Numbers Llc University

Tin Ssn Ein And Itin Taxpayer Id Numbers Llc University

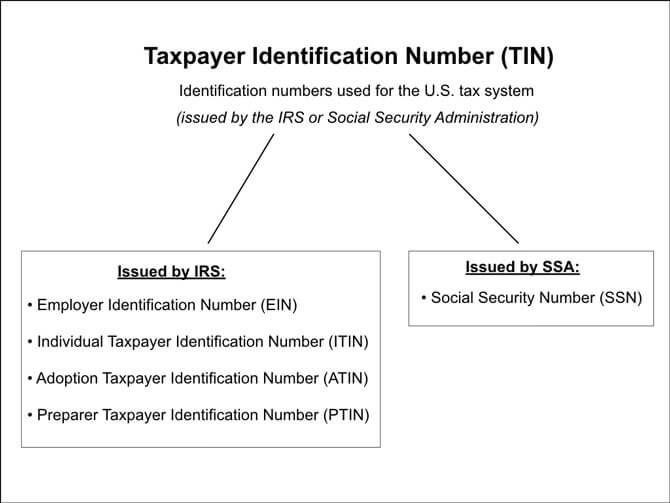

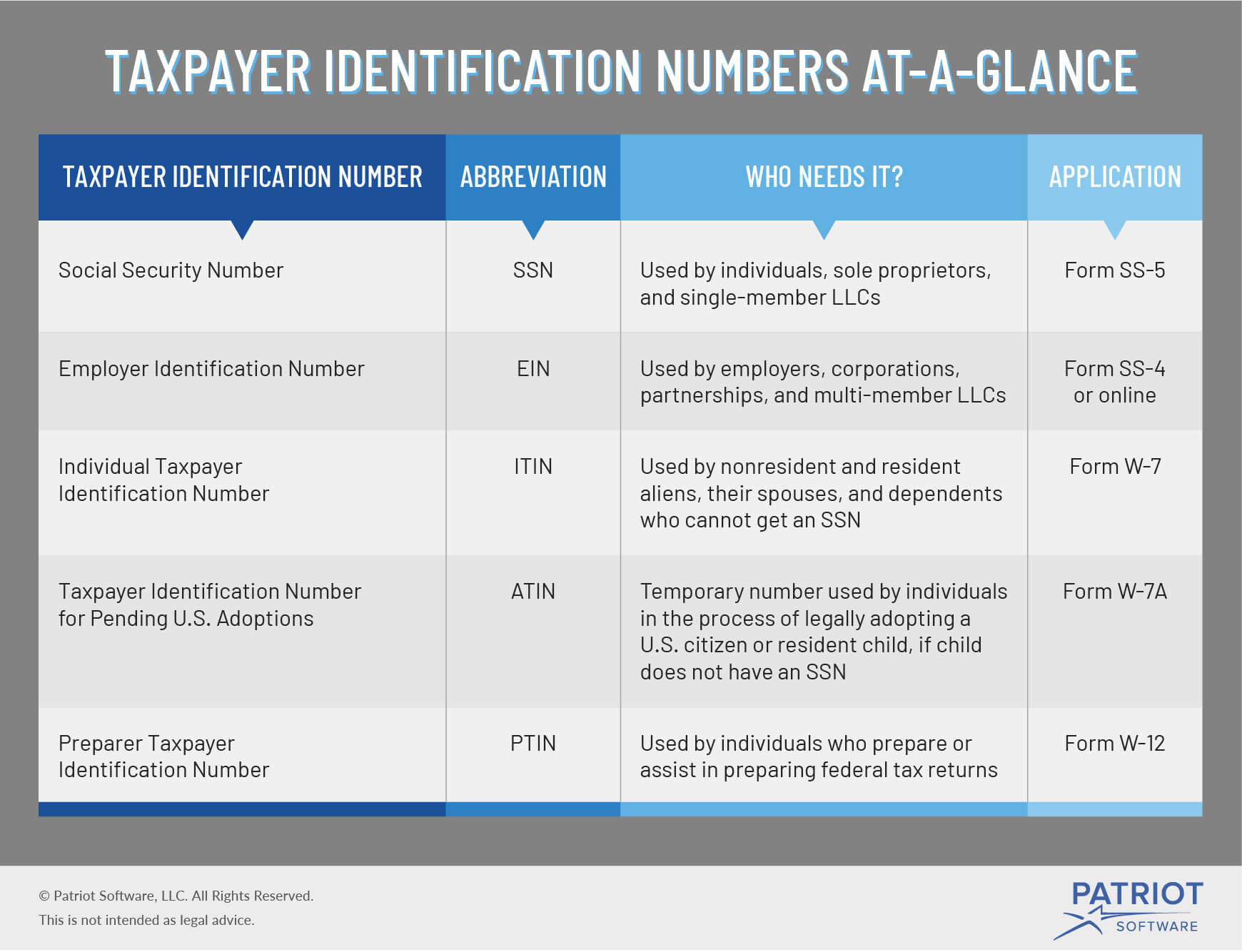

In almost all cases payees are required to provide one of these nine-digit identification numbers to obtain a TIN.

What is the format of tin number. An ITIN or Individual Taxpayer Identification Number is a tax processing number only available for certain nonresident and resident aliens their spouses and dependents who cannot get a Social Security Number SSN. TIN is a unique identification number required for every business enterprise registered under VAT. Citizens permanent residents and certain temporary residentsby the Social.

A TIN for an individual is formatted in the same way as a Social Security number. A Taxpayer Identification Number TIN is an identifying number used for tax purposes in the United States. You can obtain TIN number in Civil ID cards within 12 digits which is issued by The Public Authority for Civil Information PACI.

Unique Taxpayer Reference LL999999L 9 characters. National Insurance Number 2. This number is given once his application for the grant of GST registration is approved.

Use this field to. They do not replace Social Security numbers authorize a. The IRD number consisting of the following parts.

NIE Número de Identificación de Extranjero Foreigners Identification Number 2. Identification number and each company has a civil identification number. - 2 letters - 6 numerals - 1 letter always A B C or D NINO.

TIN Number is the nine-digit SSN or EIN for the taxpayer TIN Name is the taxpayers full name or business name Account Number is an optional field which may contain a payer-provided number which will help you interpret your Bulk TIN results. As a reminder ITINs with middle digits 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 or 87 that expired in 2016 2017 2018 or 2019 can also be renewed. A seven or eight digit base number.

Registration for tax purposes is a legal obligation of every person who is. SSNs are issued to individualsUS. It will over time replace the Tax Reference Number.

State payees include vendors who contract with a state agency to provide goods or services and individual recipients. A TIN is a 10 digit unique secure number used to identify you for tax purposes. TINs always begin with the number 9.

Permanent Account Number PAN is a ten-digit alphanumeric number issued in the form of a laminated card by the Income Tax Department to any person who applies for it. TIN description The United Kingdom does not issue TINs in a strict sense but it does have two TIN-like numbers. The TIN or OASI Number for individuals is depending on your language AHV-Versichertennummer.

Numbers TIN TIN Format Where to find it Japan Social Security and Tax Number Individual NumberMy Number 999999999999 12 characters Notification Card Individual Number Card Korea Resident Registration Number 999999 -9999999 13 characters Resident Registration Card Passport Malaysia Tax Reference Number. It is a 9-digit number beginning with the number 9 formatted like an. The Taxpayer Identification Number TIN is a unique number allocated and issued to identify a person individual or Company as a duly registered taxpayer in Nigeria.

Simply these all refer to the same thing the 9 digit number in the format of 12-3456789 that is assigned by the IRS to new entities and is used by the IRS to identify businesses and individuals for tax purposes. Who will have a TIN. How a Taxpayer Identification Number Works.

Section II TIN Structure The IRD number is a unique number issued by Inland Revenue. For most individuals their Social Security number will. TINs are for tax purposes only.

The TINEIN needs to be on any documents sent to the IRS such as tax returns. The IRD number format used by Inland Revenue is an eight or nine digit number in the format 99999999 or 999999999 depending on when it was first issued. People can apply for a TIN using IRS Form W-7 Application for IRS Individual Taxpayer Identification Number.

TIN description TIN for natural persons in Spain is unique for tax and customs purposes and contains nine characters the last of them is a letter for control. TINs are widely used around the world so our use of them will help bring Jerseys tax system in line with international best practice. Swiss tax identification number And just in case CBGeneve s link ever breaks it is summarised as.

It is to be used by that taxpayer alone. A TIN typically contains 11 characters and is provided by the IT department to all the business entities willing to register under VAT or CST. The social security number SSN is the most common tax identification number.

TIN structure Format Explanation Comment 9999999999 10 numerals UTR. Furthermore this number is made available to the applicant on the common portal once GST registration gets completed. Federal Employer Identification Number EIN.

See the ITIN Fact Sheet PDF for more information Along with your Form W-7 you will need to. Similar to Social Security numbers TINs take the XXX-XX-XXXX pattern.

3 21 263 Irs Individual Taxpayer Identification Number Itin Real Time System Rts Internal Revenue Service

3 21 263 Irs Individual Taxpayer Identification Number Itin Real Time System Rts Internal Revenue Service

All About 15 Digit Gstin Goods And Services Tax Identification Number Format Basunivesh

All About 15 Digit Gstin Goods And Services Tax Identification Number Format Basunivesh

Https Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers Azerbaijan Tin Pdf

Https Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers China Tin Pdf

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Https Ec Europa Eu Taxation Customs Tin Pdf En Tin Country Sheet Fr En Pdf

Difference Between Tin And Tan Difference Between

Https Ec Europa Eu Taxation Customs Tin Pdf En Tin Country Sheet Fr En Pdf

What Is A Taxpayer Identification Number 5 Types Of Tins

What Is A Taxpayer Identification Number 5 Types Of Tins

Https Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers China Tin Pdf

Http Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers Malta Tin Pdf

Https Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers Iom Tin Pdf

Difference Between Pan Tan And Tin

Difference Between Pan Tan And Tin

How To Get Tin Id Online 2021 Fast And Easy Way

How To Get Tin Id Online 2021 Fast And Easy Way

Https Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers Azerbaijan Tin Pdf

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Https Www Oecd Org Tax Automatic Exchange Crs Implementation And Assistance Tax Identification Numbers Iom Tin Pdf

Https Ec Europa Eu Taxation Customs Tin Pdf En Tin Country Sheet Pt En Pdf