Does An Llc Get A 1099 Misc Form

Sole proprietor Do send 1099-MISC. Generally payments to a corporation including a limited liability company LLC.

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income

If it is to a partner and reported on the k-1 as guaranteed payment which it should then issuing a 1099 will result in double reporting the income and create tax problems for the recipient.

Does an llc get a 1099 misc form. Who Receives Form 1099-MISC Form 1099 goes out to independent contractors if you pay them 600 or more to do work for your company during the tax year. 1099s you must send are as follows. Does private fund LLC need to issue 1099-Misc for its investment management fee.

Since the IRS requires that you furnish a copy of the 1099-MISC to the LLC by Jan 31 in the year after the relevant tax year youll need to have these information reporting tasks completed rather. In addition the form must be issued to anyone to whom the LLC made. However there are exceptions so understanding the laws pertaining to taxes can help make sure you follow some very important rules.

The IRS uses Form 1099-MISC to keep track of how much money or other benefits the LLC has paid an independent contractor subcontractor or other nonemployee. It depends on how the LLC is taxed. An LLC that is taxed as a corporation files different forms that replace the use of Form 1099-MISC.

Internal Revenue Service IRS requires businesses to issue a Miscellaneous Income Form 1099-MISC return to the people and companiesincluding limited liability companies LLCsthey pay if the arrangement between the business and the service provider meets certain requirements Instructions for 1099-MISC. Contractors doing business as a Limited Liability Company LLC should have a Form W-9 to show whether their LLC is taxed as a Sole Proprietorship C Corp S Corp or Partnership. However if your independent contractor has their business established as a corporation either an S Corp or a C Corp then for tax purposes they would be considered as such and would not typically be filing Form 1099s.

If youre wondering Do LLCs get 1099s the answer depends on the type of business structure. This includes S-Corporations and C-Corporations -- they also dont receive 1099 1099-MISCs. According to the IRS you must file a 1099 MISC for each person whom you have paid during the year at least 600 in rents services including parts and materials prizes and awards other income payments health care payments crop insurance proceeds cash payments for fish or generally the cash paid from a notional principal contract to an.

A Limited Liability Company LLC is an entity created by state statute. Payments for which a Form 1099-MISC is not required include all of the following. Even though an LLC will not receive the IRS 1099-MISC limited liability companies must send them out to any contractors they have hired.

The funny part about this is that if you are the one issuing a Form 1099-MISC you will have no way to tell if the vendor you are issuing to is an s-corporation since the business name will only include LLC in the title. If a company pays with a credit card or uses a third party network they would send a 1099-K not the 1099-MISC. However if an it is taxed as a partnership the IRS requires it to issue Form 1099-MISC.

Heres another way to remember. If you see its taxed as an S Corp or C Corp it does not need to receive a 1099-MISC or 1099-NEC. In general sole proprietorships may need to file these but corporations do not.

Businesses send a 1099-MISC to any contractors who they have paid more than 600 during a tax year. A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832. Additionally those whom you pay at least 10 in royalties or broker payments in lieu of.

Some payments do not have to be reported on Form 1099-MISC although they may be taxable to the recipient. In a 2 member LLC being issued 1099-MISC using or EIN and We will both be salaried employees of the LLC how do we file our taxes The business will file its own tax return - a partnership return. For that you will need TurboTax Business which is not the same as Home and Business.

In most cases companies only need to send 1099-MISCs to a contractor who has received more than 600 in payments for a calendar year. If established as a single-member LLC they file their taxes as an individual so you will provide them with the Form 1099. The 1099-MISC is the W-2 form of self-employment.

Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation partnership or as part of the owners tax return a disregarded entity. An LLC will not receive a 1099 if taxed as an s-corporation. In general Form 1099-Misc must be issued to any business or person to whom your LLC made payments totaling 600 or more for rents services prizes or awards or other payments of income.

But not an LLC thats treated as an S-Corporation or C-Corporation. 1099-MISCs should be sent to single-member limited liability company or LLCs or a one-person Ltd.

1099 Misc And 1099 Nec Deadline Feb 1 2021 Tax Practice Advisor

1099 Misc And 1099 Nec Deadline Feb 1 2021 Tax Practice Advisor

Which 1099 Forms Should You Complete

Which 1099 Forms Should You Complete

What Is A 1099 Misc Form Financial Strategy Center

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

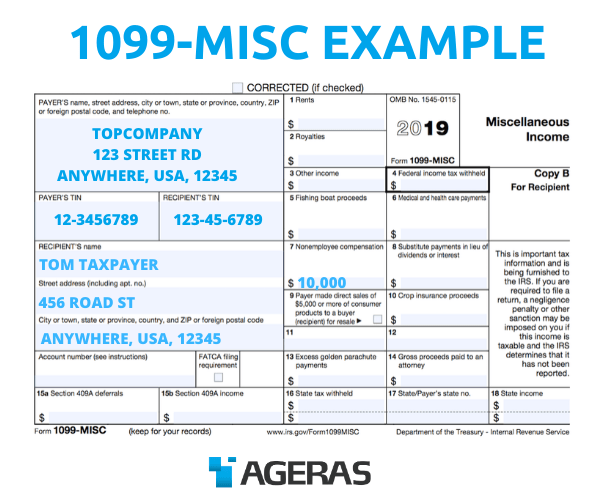

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Irs Tax Form 1099 How It Works And Who Gets One Ageras

Irs Makes Substantial Changes To 1099 Misc Form Williams Keepers Llc

Irs Makes Substantial Changes To 1099 Misc Form Williams Keepers Llc

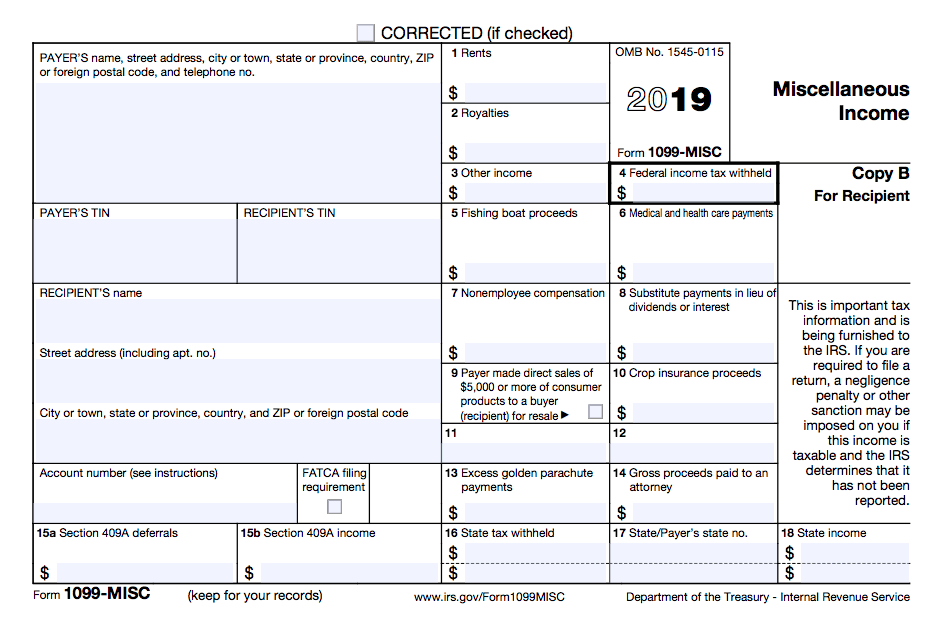

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

What Is 1099 Misc Form How To File It Complete Guide

What Is 1099 Misc Form How To File It Complete Guide

1099 Misc Instructions And How To File Square

1099 Misc Instructions And How To File Square

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

2020 Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Cpa Practice Advisor

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

What Is 1099 Misc Form How To File It Complete Guide

What Is 1099 Misc Form How To File It Complete Guide

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver