Dividend Declaration Rules As Per Companies Act 2013

241 E In exercise of the powers conferred under sub-section 1 of section 123 read with section 469 of the Companies Act 2013 18 of 2013 and in supersession of the Companies Central Governments General Rules and Forms 1959 and other Rules prescribed. Dividend is basically the share of profit distributed among shareholders.

Interim Dividend As Per Companies Act 2013

Interim Dividend As Per Companies Act 2013

Once the dividend is declared it shall be debt that must be paid by the company to its shareholders.

Dividend declaration rules as per companies act 2013. Dividend is generally defined as a pro-rata share in an amount to be distributed or a sum of money paid to the shareholders of. According to the provisions of Companies Act - 2013 No dividend shall be payable except by way of cash where dividend payable in cash can also be paid through cheque warrant or in any electronic mode to the shareholder who is entitled to the dividend. It can be paid annually once or during the year.

The term Dividend used except in the definition in Companies Act 2013 refers to final dividends only. It is paid to shareholder for their investment in shares of company. No company shall declare dividend unless carried over previous losses and depreciation not provided in previous year or years are set off against profit of the company for the current year.

New Delhi Dated 31032014. The Dividend is paid as per provisions of companies act 2013 and companies declaration and payment of dividend rules 2014. 1 No dividend shall be declared or paid by a company for any financial year except.

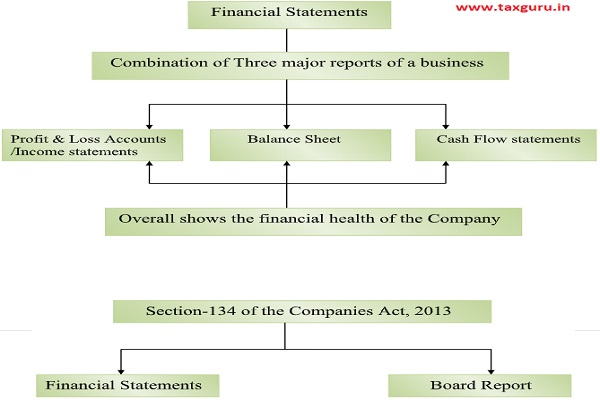

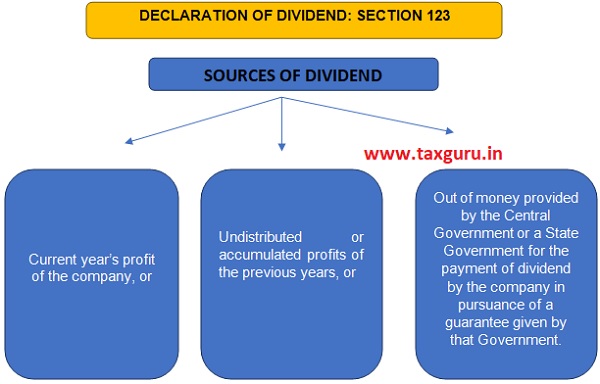

As per Section 2 35 of Companies Act 2013 defines the term as including any interim dividend. Section 123 of the Companies Act 2013 provides that dividend should be declared by the company on such rate at its annual general meeting as recommended by the board. Under the Companies Act 2013 hereinafter referred to as CA ACT 2013 Section 123 to 127 of Chapter VIII deals with the provisions related to the declaration and payment of dividend.

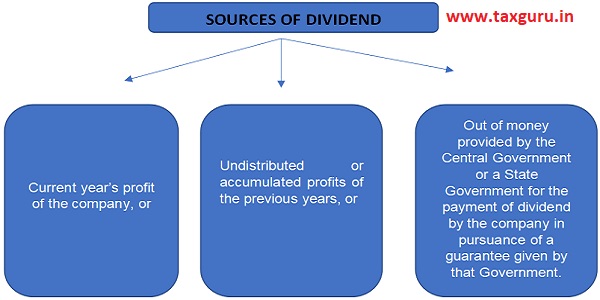

Companies licensed under Section 8 of the Companies Act 2013 or corresponding provisions of any previous enactment thereof are prohibited by their constitution from paying any Dividend to its Members. The dividends declared by the company after closing of the financial year and approval of Board of Directors in AGM. A out of the profits of the company for that year arrived at after providing for depreciation in accordance with the provisions of sub-section 2 or out of the profits of the company for any previous financial year or years.

Ordinary meaning of dividend is a share of profits whether at a fixed rate or otherwise allocated to holders of. The amount of dividend approved by the board cannot be exceeded by the company. Section 2 35 of Companies Act 2013 Act for short defines the term as including any interim dividend.

AA proviso for S 123 1 was inserted vide Companies Amendment Act 2015 wherein it states that no company shall declare dividend unless carried over previous losses and depreciation not provided in previous year or years are set off against profit of the company for the current year. No exact definition has been given in the Act. In pursuant to subsection 3 of section 123 of Companies Act 2013 and relevant rules made thereunder a dividend is said to be an Interim dividend if it is declared by the board of directors during any financial year or at any time during the period from the closure of financial year till holding of the annual general meeting.

1 The rate of dividend declared shall not exceed the average of the rates at which dividend was declared by it in the three years immediately preceding that year. 22 rows Article explains statutory provisions related to Declaration and payment of. Section 123 of Companies Act 2013 Declaration of Dividend.

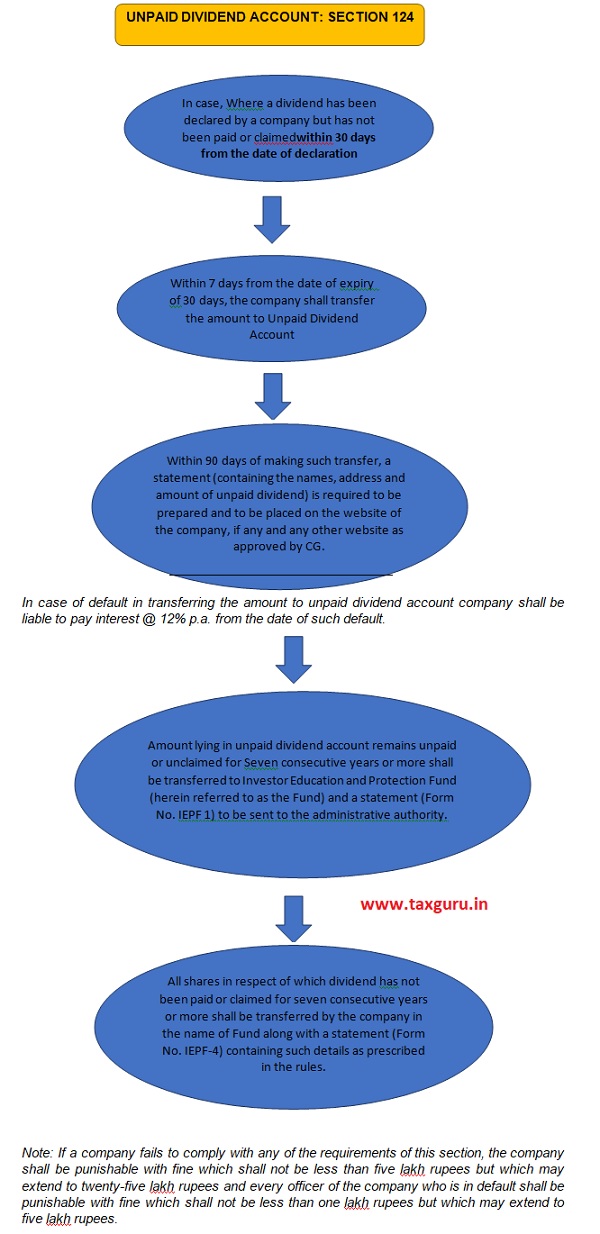

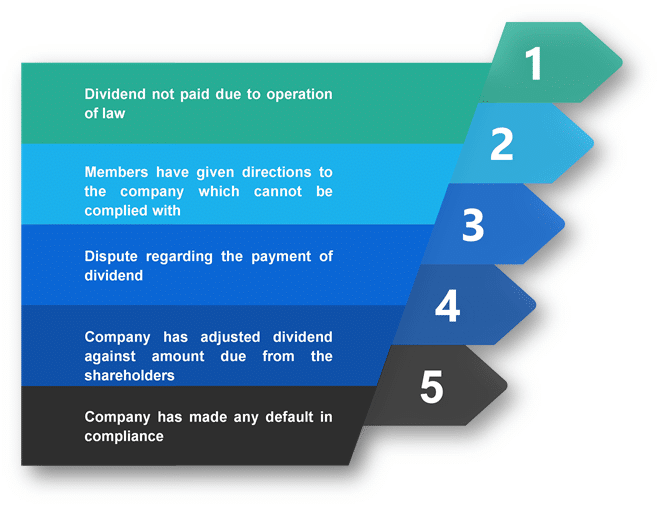

Where a dividend has been declared by a company but has not been paid or claimed within thirty days from the date of the declaration to any shareholder entitled to the payment of the dividend the company shall within seven days from the date of expiry of the said period of thirty days transfer the total amount of dividend which remains unpaid or unclaimed to a special account to be. I Section 51 permits companies to pay dividends proportionately ie. In proportion to the amount paid-up on each share when all.

The rate of dividend is not fixed it depends on the profitability of the company. Dividend under the Companies Act 2013 The Companies Act 2013 lays down certain provisions for declaration of dividend which are. Chapter VIII The Companies Declaration and Payment of Dividend Rules 2014.

19032020 up to 23032020. Year any company proposes to declare dividend out of the accumulated profits earned by it in previous years and transferred by the company to the reserves such declaration of dividend shall not be made except in accordance with such rules as may be prescribed in this behalf. AS PER COMPANIES ACT 2013 The company is required to deposit the amount of dividend so declared within 5 days from the date of declaration of Dividend ie.

This sub-rule shall not apply to a company which has not declared any dividend in each of the three preceding financial year.

Dividend And Payment Of Dividends Under Companies Act 2013 Law Times Journal

Declaration And Payment Of Dividend Ppt Download

Declaration And Payment Of Dividend Ppt Download

Declaration And Payment Of Dividend Under Companies Act 2013

Declaration And Payment Of Dividend Under Companies Act 2013

Complete Analysis On Section 123 Of Companies Act 2013

Complete Analysis On Section 123 Of Companies Act 2013

Summary Of Provisions Related To Dividend In Companies Act 2013

Summary Of Provisions Related To Dividend In Companies Act 2013

Declaration And Payment Of Dividend Ppt Download

Declaration And Payment Of Dividend Ppt Download

Pin On Indian Companies Act 2013

Pin On Indian Companies Act 2013

Declaration Of Dividend Under Companies Act 2013

Declaration Of Dividend Under Companies Act 2013

Analysis Of Disclosure Of Beneficial Interest Under Companies Act 2013

Analysis Of Disclosure Of Beneficial Interest Under Companies Act 2013

Declaration And Payment Of Dividend Under Companies Law

Declaration And Payment Of Dividend Under Companies Law

Dividends Audit And Accounts Under The Companies Act 2013 Ipleaders

Dividends Audit And Accounts Under The Companies Act 2013 Ipleaders

Companies Act 2013 Financial Statement Board Report

Companies Act 2013 Financial Statement Board Report

Declaration Of Dividend Under Companies Act 2013

Declaration Of Dividend Under Companies Act 2013

Declare And Pay Dividend In Case Of Loss Or Inadequate Profits

Declare And Pay Dividend In Case Of Loss Or Inadequate Profits

Procedure For Declaration Of Interim Dividend Lawrbit

Procedure For Declaration Of Interim Dividend Lawrbit

Declaration And Payment Of Dividend Under Companies Act Enterslice

Declaration And Payment Of Dividend Under Companies Act Enterslice

Declaration And Payment Of Dividend Under Companies Law

Declaration And Payment Of Dividend Under Companies Law

Balance Sheet Profit And Loss Account Under Companies Act 2013 Accounting Taxation Balance Sheet Accounting Profit

Balance Sheet Profit And Loss Account Under Companies Act 2013 Accounting Taxation Balance Sheet Accounting Profit