1099 Business Model

The 1099-MISC form used to include payments made to nonemployees but in 2020 these payments were segregated on their own Form 1099-NEC. I received a 1099-K but I do not run my own business and the items I sold were personal items.

What Is A 1099 Form A Simple Breakdown Of The Irs Tax Form

What Is A 1099 Form A Simple Breakdown Of The Irs Tax Form

1099-NEC is just for independent contractor payments of 600 or more and 1099-MISC will.

1099 business model. Sheila pays 100000 for an SUV Average price of a Model X with a. This form must be issued for health care services provided and for legal services delivered by attorneys. Principal business code for 1099 The principle business code is a six digit code that corresponds to the type of work you perform.

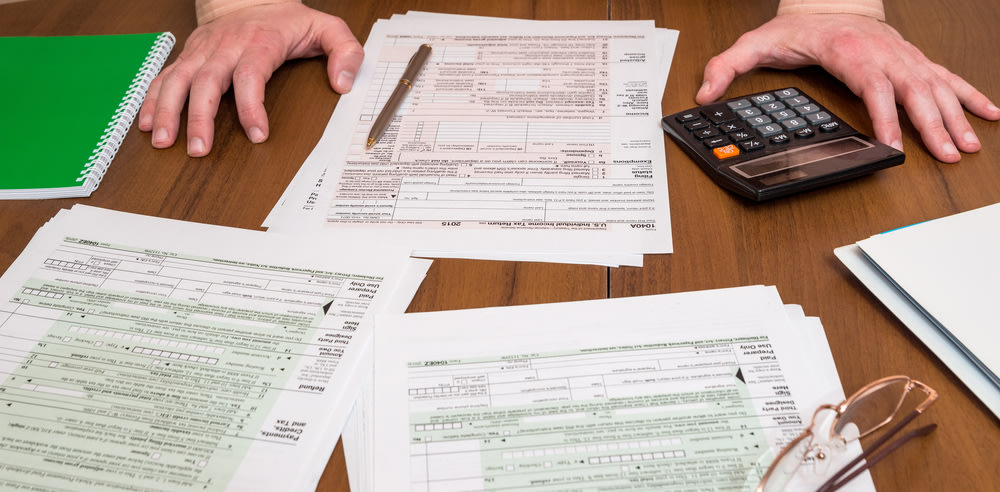

How you report 1099-MISC income on your income tax return depends on the type of business you own. Simply click the Lookup Business Codes button enter some keywords that describe your business eg day care. With the contract counseling models of private practice the therapists you have hired are not employees and they will need to bill you for their services to keep the IRS happy.

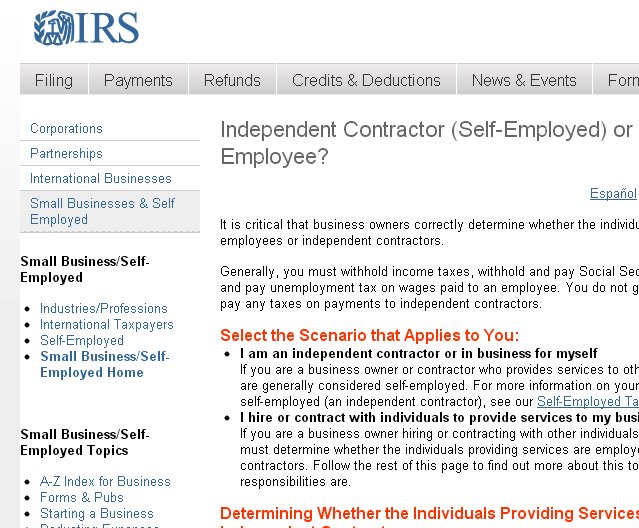

For tax year 2020 and going forward Form 1099-MISC covers only miscellaneous payments. Report payments made of at least 600 in the course of a trade or business to a person whos not an employee for services Form 1099-NEC. The debate is about two diametrically opposed business models Employee Based or Independent Contractor classified as 1099.

This form replaces the need for a W-2 and indicates that they are not an employee no employer is responsible for paying FICA taxes or withholding income tax and the independent. Your business may still need to file both forms. For example freelancers and independent contractors often get a.

Business codes are used by the IRS to categorize your business for statistical purposes onlyThe code you enter will not affect the outcome of your tax return. I do not have a - Answered by a verified Tax Professional. Including 1099 Income on Your Tax Return.

The codes are defined on the IRS 1099 Form Box page where you can also add new 1099 codes. We use cookies to give you the best possible experience on our website. The other model leases or rents space to individuals to do their own work.

Report payments of 10 or more made in the course of a trade or business in gross royalties or payments of 600 or more made in the course of a trade or business in rents or for other specified purposes Form 1099-MISC. When your set up your business in TurboTax youll eventually come to the Enter Your Business Code screen. One business model employs individuals to do the work.

All kinds of people can get a 1099 form for different reasons. They can be compensated purely as 1099 workers from the brokerdealer in which case they dont get any of the employment benefits. This program is so easy it just walked me through it step by step.

The Model S is under 6000 lbs GVWR so it doesnt qualify. They are self-employed workers also called independent contractors. For each tax liable vendor you can then specify the relevant 1099 code on the Payments FastTab on the Vendor card.

You may need to use 1099-MISC for other business payments like rent certain medical or healthcare payments and other specific costs. Companies that use a 1099 business model or have failed to properly structure document and implement their independent contractor relationships in a. In Business Central the most common 1099 codes are already set up for you so you are ready to generate the required reports.

You may begin to receive these documents as a. To see a list of. You can obtain a substantial first-year deduction if your business car isnt a passenger vehicle Example.

The second and more popular approach is more of a hybrid model whereby they have a relationship with the brokerdealer Woodbury and the brokerdealer gives them 1099 income but at the same time a portion their compensation is paid. A 1099 form is a record of income. At the end of the year you will need to complete a 1099 form with the IRS showing what you paid them during the year.

Typically youll receive a 1099 because you earned some form of income from a non-employer source. I have avoided doing my taxes because I am a self employed contractor with several 1099s and needing to do a schedule C. Federal 0 State 1499.

Small Business Owners Prepare and E-file Your Federal Taxes for 0. Form 1099 reports the income that independent contractors receive throughout the year to the IRS for tax purposes. If you are a sole proprietor or single-member LLC owner you report 1099 income on Schedule CProfit or Loss From BusinessWhen you complete Schedule C you report all business income and expenses.

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

How To Manage 1099 Sales Reps Independent Contractors

How To Manage 1099 Sales Reps Independent Contractors

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

![]() Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Looking To Hire W2 Vs 1099 Which Is Best For Your Business

![]() Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Looking To Hire W2 Vs 1099 Which Is Best For Your Business

New Form 1099 Reporting Requirements For 2020 Atkg Llp

New Form 1099 Reporting Requirements For 2020 Atkg Llp

Amazon Com 1099 Nec Tax Forms 2020 Tangible Values 4 Part 25 Pack Kit With Envelopes Software Download Included Office Products

Amazon Com 1099 Nec Tax Forms 2020 Tangible Values 4 Part 25 Pack Kit With Envelopes Software Download Included Office Products

Adding 1099 Contractors To Your Practice How To Start Grow And Scale A Private Practice Practice Of The Practice

Adding 1099 Contractors To Your Practice How To Start Grow And Scale A Private Practice Practice Of The Practice

Free Independent Contractor Agreement Templates Pdf Word Eforms

Employee Vs Independent Contractor Apollomd

Employee Vs Independent Contractor Apollomd

What Is A 1099 Employee And Should You Hire Them Employers Resource

What Is A 1099 Employee And Should You Hire Them Employers Resource

16 Criteria To Determine Your Worker Status 1099 Or W 2 Independent Contractor Tax Advisors

16 Criteria To Determine Your Worker Status 1099 Or W 2 Independent Contractor Tax Advisors

![]() Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Irs Forms W 9 Vs 1099 What S The Difference

Irs Forms W 9 Vs 1099 What S The Difference

Amazon Com New 1099 Nec Forms For 2020 4 Part Tax Forms Vendor Kit Of 25 Laser Forms And 25 Self Seal Envelopes Forms Designed For Quickbooks And Other Accounting Software Office Products

Amazon Com New 1099 Nec Forms For 2020 4 Part Tax Forms Vendor Kit Of 25 Laser Forms And 25 Self Seal Envelopes Forms Designed For Quickbooks And Other Accounting Software Office Products

![]() Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Looking To Hire W2 Vs 1099 Which Is Best For Your Business