Withdraw Money From Business Account For Personal Use Journal Entry

1 5 0 0 0 from Jimmi. Owner deposit and withdrawal of money into business.

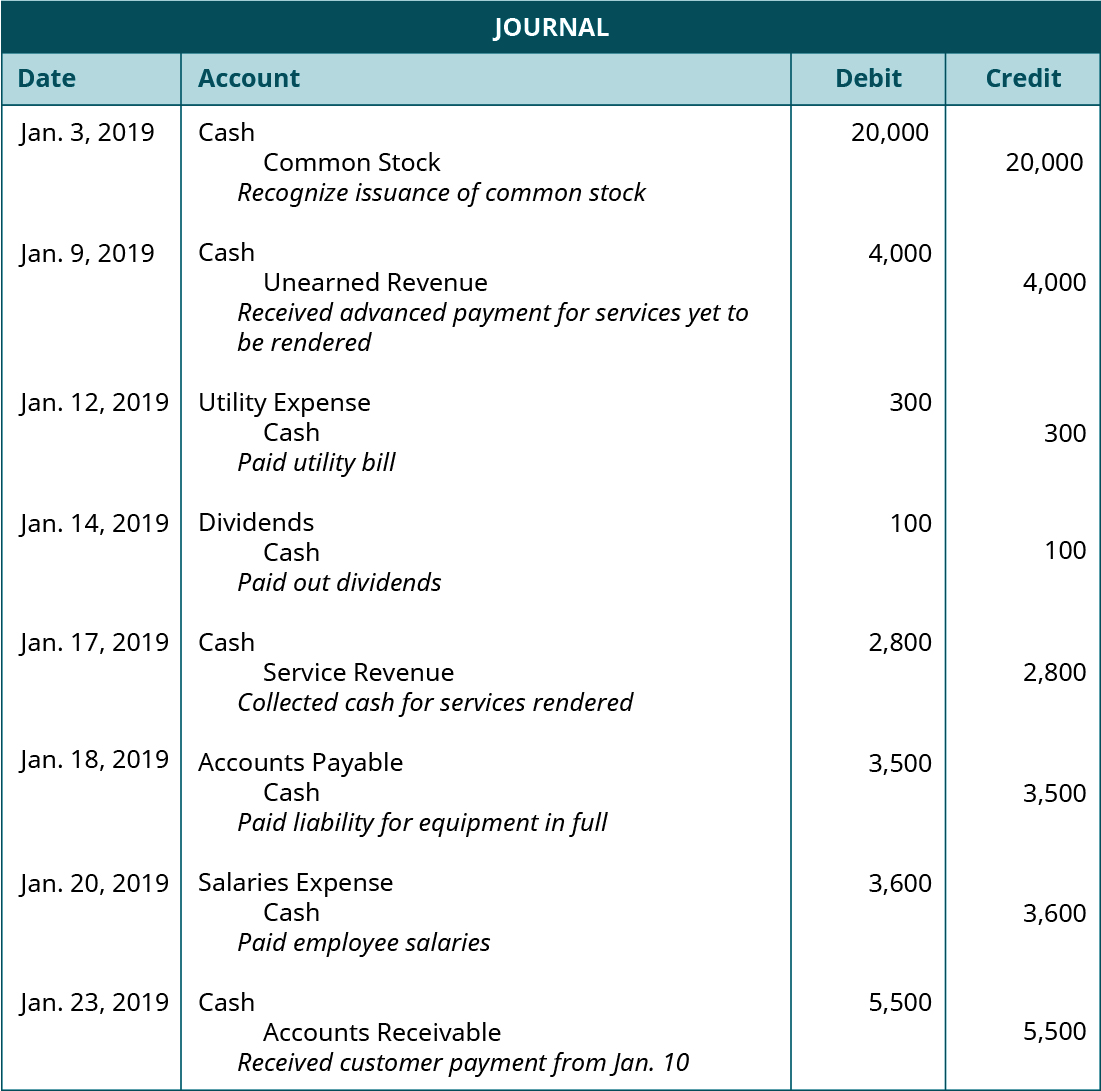

Use Journal Entries To Record Transactions And Post To T Accounts

Use Journal Entries To Record Transactions And Post To T Accounts

When a business owner has goods withdrawn for personal use they are recorded on the drawings account.

Withdraw money from business account for personal use journal entry. Type the owners name if you want to record the withdrawal in the Owners Draw account. On February 1 2 0 1 1 John purchased goods for Rs. Putting personal money into a business can help you overcome startup funding needs but can also create unnecessary risk if done incorrectly.

More_vert Journal entry for owners withdrawal Prepare a journal entry on December 23 for the withdrawal of 20000 by Steve Buckley for personal use. The cash account is listed in the assets section of the balance sheet. To record the withdrawal of Dale from the partnership the journal entry is.

The drawings account is a temporary account and is cleared at the end of each year either by a debit against the capital account. Accounting Accounting Journal entry for owners withdrawal Prepare a journal entry on December 23 for the withdrawal of 20000 by Steve Buckley for personal use. Burnham put assets into the business except.

The owner has effectively withdrawn part of their equity. Credit or decrease the cash account and debit or increase the drawing account. Record a cash withdrawal.

Credit or decrease the cash account and debit or increase the drawing account. Otherwise you report it in the Drawing account and credit Cash for the amount removed. Fill in the information.

In the case of goods withdrawn by owners for personal use purchases are reduced and ultimately the owners capital is adjusted. In the Bank Account section choose the Cash Account. The double entry above is actually the exact opposite of our earlier owners equity journal entry capital where Mr.

For example if you withdraw 5000 from your sole proprietorship credit cash and debit the drawing account by 5000. Since only balance sheet accounts are involved cash and owners equity owner. We keep the capital account as one account for investments in the business by the owner and drawings as a separate account to show only divestments or withdrawals by the owner.

When you take money out of your business you need to make a journal entry for cash withdrawn for personal use. How to Record Cash Withdrawal used for Business Expense. Five days before the maturity of the bill Jimmi sent the same to his bank for collection.

For example if you withdraw 5000 from your sole proprietorship credit cash and debit the drawing account by 5000. The cash account is listed in the assets section of the balance sheet. 5 0 0 0 by cheque and for the balance accepted the bill of exchange drawn upon him by Jimmi.

Whenever goods or cash are withdrawn from business for personal use or any payment is made from business bank ac for personal expenses then it is termed. Yes equity would work as long as the company is not taxed as a c- or s-corp if it is a corporation then you have to use a current liability account to show what the company owes her. Why is the bank account credited.

The bill of exchange was payable after 4 0 days. The drawings account has been debited reducing the owners equity in the business. This is a payroll expense if you pay yourself a salary.

For example assume that after much discussion Dale is ready to retire. Recording - Journal Entry Drawings of stock is also an accounting transaction and has to be brought into the books of accounts through a journal entry. For example if a business owner has goods withdrawn for personal use which cost 600 then the amount must be recorded on the owners drawings account and not as an expense for the business.

Assuming no tax is involved in the purchase of the inventory by the business then the bookkeeping journal entry. Its important to account for withdrawals. In this case a liability accounts payable increases as the owner has used the suppliers account to pay for personal expenses.

Record a cash withdrawal. It reduces the total capital invested by the proprietor s. It is also called a withdrawal account.

As per the golden rule of accounting the bank account is classified as a personal account. Each partner has capital account balances of 60000. Ciara and Remi agree to pay Dale 30000 each to close out his partnership account.

As per the rule for a personal account. To record an owner withdrawal the journal entry should debit the owners equity account and credit cash. He immediately made a payment of Rs.

Type Cash in the Pay to the Order Of field if you want to use your Petty Cash account. Lets ensure when you enter a check the bank account is under the cash account. In accounting assets such as Cash or Goods which are withdrawn from a business by the owner s for their personal use are termed as drawings.

Hence when the cash is withdrawn for the office use we receive cash hence cash account is debited. You need to make sure you properly account for the money on your business books so you accurately track the amount your business either owes you or how much ownership you have. Drawings of stock implies stock or goods taken away by the proprietor or partner for personal purposes.

Personal Expenses And Drawings Double Entry Bookkeeping

Personal Expenses And Drawings Double Entry Bookkeeping

General Journal Download Pdf Accounting Form Spreadsheet Template Bookkeeping Templates Weekly Budget Template

General Journal Download Pdf Accounting Form Spreadsheet Template Bookkeeping Templates Weekly Budget Template

General Ledger Sheet Template Double Entry Bookkeeping General Ledger Bookkeeping Templates Balance Sheet

General Ledger Sheet Template Double Entry Bookkeeping General Ledger Bookkeeping Templates Balance Sheet

Free Printable General Ledger Sheet Small Business Bookkeeping General Ledger Balance Sheet Template

Free Printable General Ledger Sheet Small Business Bookkeeping General Ledger Balance Sheet Template

Financial Asset Inventory Form Financial Asset Inventory Turnover Financial

Financial Asset Inventory Form Financial Asset Inventory Turnover Financial

Small Business Accounting Archives Mirex Marketing Small Business Accounting Bookkeeping Business Accounting

Small Business Accounting Archives Mirex Marketing Small Business Accounting Bookkeeping Business Accounting

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

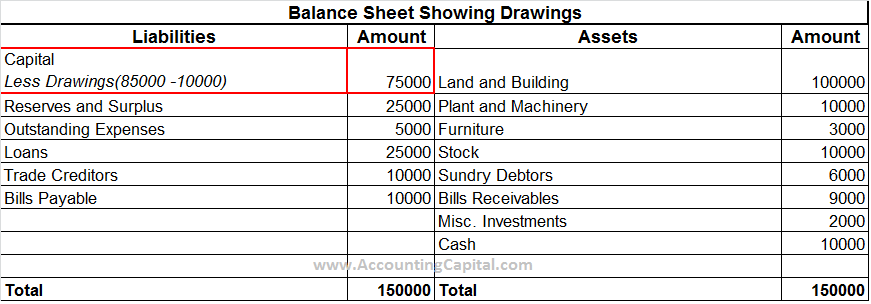

Recording Transactions Using Journal Entries

Recording Transactions Using Journal Entries

Goods Distributed As Free Samples Double Entry Bookkeeping

Goods Distributed As Free Samples Double Entry Bookkeeping

Account Ledger Printable 8 Printable Ledger Bookletemplate Org Balance Sheet Template Excel Templates Practices Worksheets

Account Ledger Printable 8 Printable Ledger Bookletemplate Org Balance Sheet Template Excel Templates Practices Worksheets

General Ledger For Dummies With Pictures General Ledger Bookkeeping Business Bookkeeping Templates

General Ledger For Dummies With Pictures General Ledger Bookkeeping Business Bookkeeping Templates

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

A Cash Book Is A Financial Journal In Which Cash Receipts And Payments Including Bank Deposits And Withdrawals Are Recorded First I Accounting Notes Cash Books

A Cash Book Is A Financial Journal In Which Cash Receipts And Payments Including Bank Deposits And Withdrawals Are Recorded First I Accounting Notes Cash Books

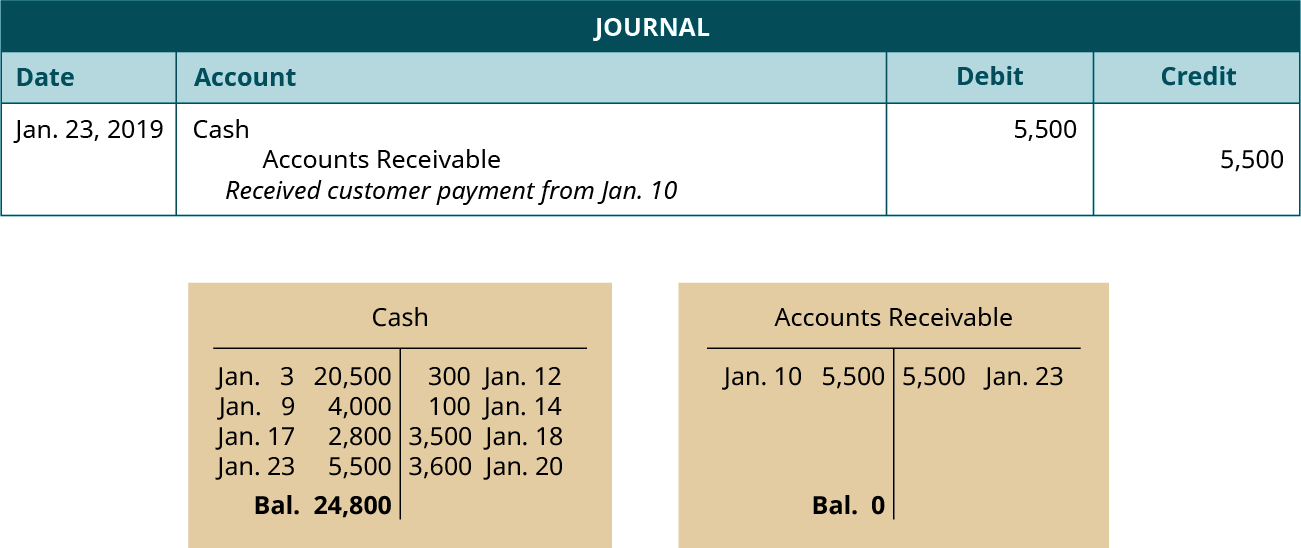

Analyze And Record Transactions For The Sale Of Merchandise Using The Perpetual Inventory System Principles Of Accounting Volume 1 Financial Accounting

Analyze And Record Transactions For The Sale Of Merchandise Using The Perpetual Inventory System Principles Of Accounting Volume 1 Financial Accounting

Single Entry Bookkeeping Bookkeeping Business Small Business Bookkeeping Bookkeeping Templates

Single Entry Bookkeeping Bookkeeping Business Small Business Bookkeeping Bookkeeping Templates

Journal Entry For Cash Withdrawn From Bank Class 11 Book Keeping And Accountancy Journal Entries Journal Withdrawn

Journal Entry For Cash Withdrawn From Bank Class 11 Book Keeping And Accountancy Journal Entries Journal Withdrawn

General Ledger Ms Word Template General Ledger Word Template Journal Template

General Ledger Ms Word Template General Ledger Word Template Journal Template

Goods Withdrawn For Personal Use Double Entry Bookkeeping

Goods Withdrawn For Personal Use Double Entry Bookkeeping

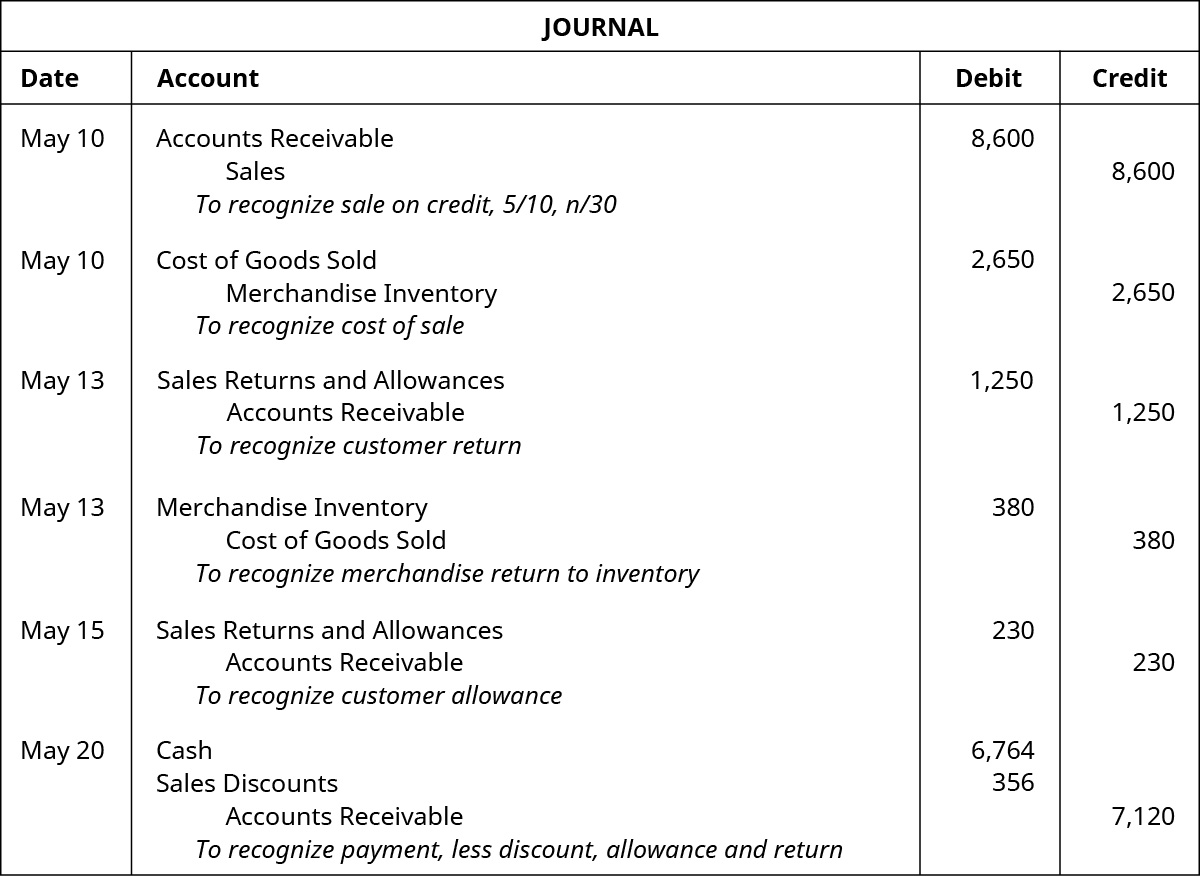

Drawings Journal Entry Goods Cash With Examples Accountingcapital

Drawings Journal Entry Goods Cash With Examples Accountingcapital