What Does Disregarded As An Entity Separate From Its Owner Mean

An LLC is typically considered as a separate entity from the owners. A single-member LLC SMLLC for example is considered to be a disregarded entity.

Pros And Cons Of Being A Disregarded Entity Legalzoom Com

Pros And Cons Of Being A Disregarded Entity Legalzoom Com

A disregarded entity refers to a business with one owner that is not recognized for tax purposes as an entity separate from its owner.

What does disregarded as an entity separate from its owner mean. A Disregarded Entity refers to a business entity owned by one person but is separate from its owner for liability purposes. For legal purposes the LLC and its owner are still separate and the LLC still protects the personal assets of its owner. The name of the entity entered on line 1 should never be a disregarded entity.

That means the business is not required to file its own tax return and instead the owner reports their business profits on their personal return. In other words these entities are regarded as separate in terms of liability but disregarded as separate in terms of taxation. The IRS simply treats the LLC and its owner as the same person.

1 3. Determining Disregarded Entity Status. However profits from it are reported on the owners personal tax returns.

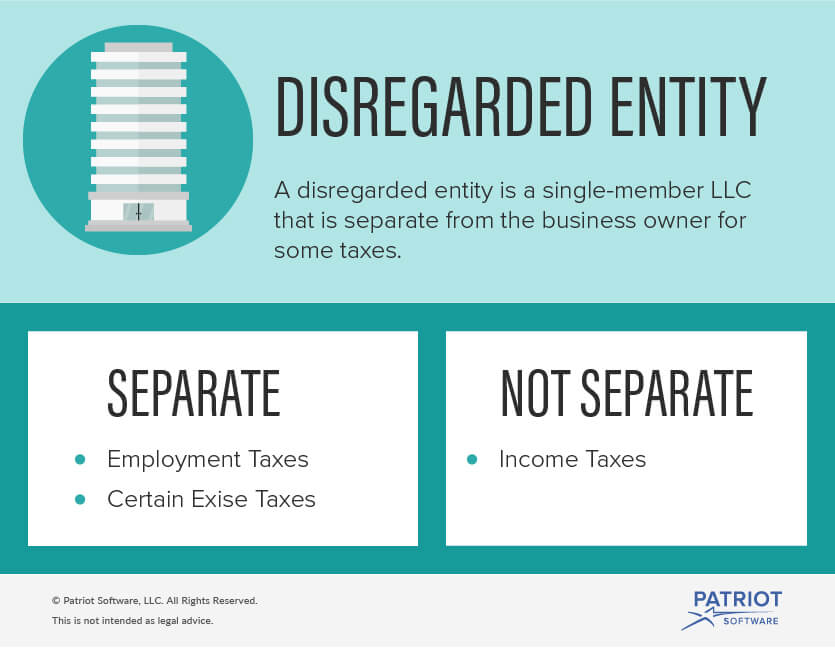

In short a disregarded entity is a business that is not considered to be a separate entity from its owner for tax purposes. A disregarded entity is a single-member LLC. Another way to say this is that the business is not separated from the owner for tax purposes.

1 If this sounds like a double negative it is. It must meet all three of these criteria. Sole proprietorships and partnerships are not disregarded entities because the business does not exist as a separate entity from the owner.

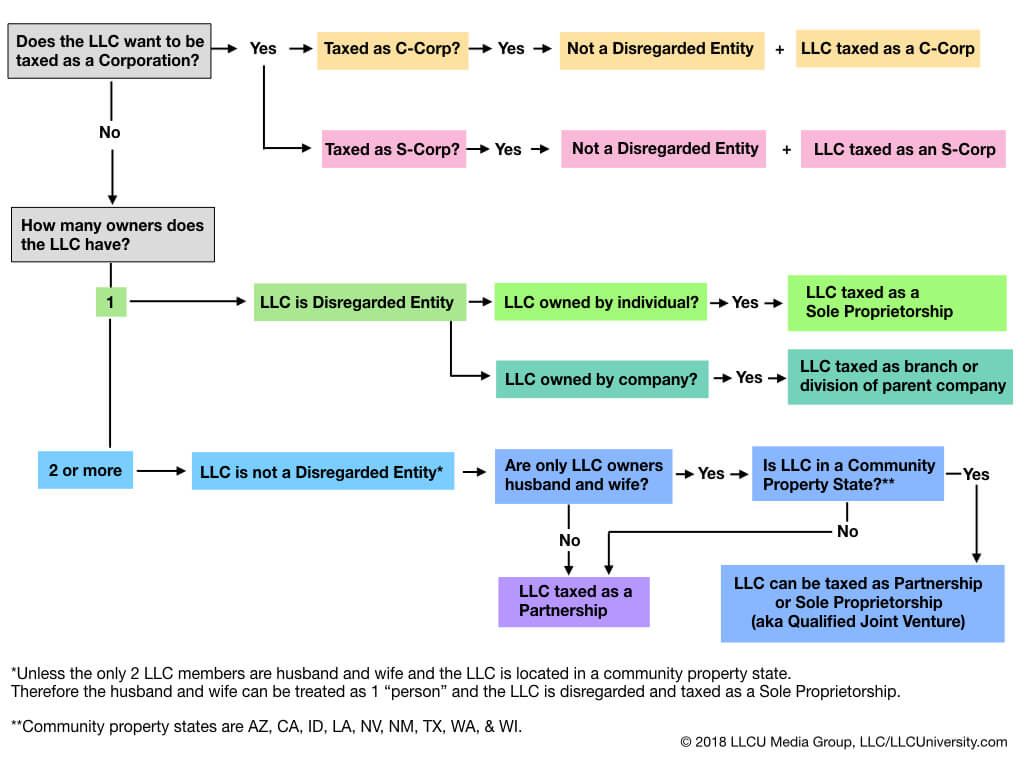

A disregarded entity is a business entity considered separate from the owner when it comes to liability and the same as the owner for tax purposes. A disregarded entity is a tax classification reserved for single-member limited liability companies LLC. Federal tax purposes an entity that is disregarded as an entity separate from its owner is treated as a disregarded entity See Regulations section 3017701-2 c 2 iii.

Corporations are generally not disregarded for tax purposes. A disregarded entity is a business structure other than a corporation that hasnt elected to be treated as a separate entity for federal tax purposes. What is a disregarded entity.

This is just for federal taxes though. However for purposes of employment tax and certain excise taxes an LLC with only one member is still considered a separate entity. For tax purposes the IRS treats the disregarded entity as part of the owners tax return.

A disregarded entity is a one-person business structure thats not taxed separately from its owner. The business owner essentially wants the IRS to disregard the fact that the business is a. If your LLC is deemed a disregarded entity it simply means that in the eyes of the IRS your LLC is not taxed as an entity separate from you the owner.

Disregarded Entity is a term used by the IRS for Single-Member LLCs meaning that the LLC is ignored for tax purposes. The owner claims the business on personal taxes but when liability issues arise the owners personal assets are protected. The term disregarded entity refers to a business entity thats a separate entity from its owner but that is considered to be one in the same as the owner for federal tax purposes.

A disregarded entity is a business that is separate from its owner but which elects to be disregarded as separate from the business owner for federal tax purposes. For federal and state tax purposes the entity is disregarded meaning the entity does not file a separate tax return. A disregarded entity is a business unit that is separate from its owner except when it comes to taxes.

However an LLC with only one member is disregarded as separate from its owner for income tax purposes. The business has just one owner. When you register your LLC with the state to form your business the Internal Revenue Service actually doesnt recognize that LLC as a business that needs to pay taxes.

A disregarded entity is an incorporated business that is considered separate from the owner for liability purposes Point 1 above but is considered the same as the owner for tax purposes Point 2. An example of a disregarded entity is a single-member LLC as it absorbs the liabilities. A disregarded entity refers to a business entity with one owner that is not recognized for tax purposes as an entity separate from its owner.

Sole proprietorships and single-member LLCs are considered to be disregarded entities. Enter the owners name on line 1. This is because the IRS disregards that the owner and business are separate from each other.

For income tax purposes an LLC with only one member is treated as an entity disregarded as separate from its owner unless it files Form 8832 and affirmatively elects to be treated as a corporation. The term disregarded entity refers to how a single-member limited liability company LLC may be taxed by the Internal Revenue Service IRS.

Do I Have To Register As A Foreign Business Entity A Guide To Doing Business In Arizona Law Firm Income Tax Business Perspective

Do I Have To Register As A Foreign Business Entity A Guide To Doing Business In Arizona Law Firm Income Tax Business Perspective

Do I Need To File A Tax Return For An Llc With No Activity Legalzoom Com

Do I Need To File A Tax Return For An Llc With No Activity Legalzoom Com

Pros And Cons Of Being A Disregarded Entity Legalzoom Com

Pros And Cons Of Being A Disregarded Entity Legalzoom Com

Disregarded Entity Irs Form Instructions W9manager

Disregarded Entity Irs Form Instructions W9manager

What Is A Disregarded Entity And How Does It Affect Your Taxes

What Is A Disregarded Entity And How Does It Affect Your Taxes

Is An Llc Required To Have A Separate Bank Account Legalzoom Com

Is An Llc Required To Have A Separate Bank Account Legalzoom Com

What Is A Disregarded Entity Single Member Llc

What Is A Disregarded Entity Single Member Llc

How Do I Pay Myself From My Llc Salary Or Draw Bizfilings

How Do I Pay Myself From My Llc Salary Or Draw Bizfilings

What Is A Disregarded Entity Single Member Llc

What Is A Disregarded Entity Single Member Llc

What Is A Disregarded Entity Llc Llc University

What Is A Disregarded Entity Llc Llc University

What Is A Disregarded Entity Llc Llc University

What Is A Disregarded Entity Llc Llc University

Free Report What Does It Mean To Respect Corporate Formalities In Arizona Lotzar Law Firm P C Law Firm Corporate Business Perspective

Free Report What Does It Mean To Respect Corporate Formalities In Arizona Lotzar Law Firm P C Law Firm Corporate Business Perspective

7 Common Questions About Foreign Owned U S Llcs Answered By A Cpa O G Tax And Accounting

7 Common Questions About Foreign Owned U S Llcs Answered By A Cpa O G Tax And Accounting

Chief White Cloud Books Nooks Native American Quotes Native American Wisdom Native Indian

Chief White Cloud Books Nooks Native American Quotes Native American Wisdom Native Indian

What Is A Disregarded Entity Llc

What Is A Disregarded Entity Llc

Is The Single Member Llc A Solution For Me Mark J Kohler

Is The Single Member Llc A Solution For Me Mark J Kohler

Disregarded Entities What Is A Disregarded Entity Nav

Disregarded Entities What Is A Disregarded Entity Nav

What Is A Disregarded Entity Llc Legalzoom Com

What Is A Disregarded Entity Llc Legalzoom Com

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

What Is A Disregarded Entity And How Are They Taxed Ask Gusto