Business Travel Reimbursement Rate 2019

July 1 2019 Sept 30 2019. In 2019 the IRS standard mileage reimbursement rate was 58 cents per mile.

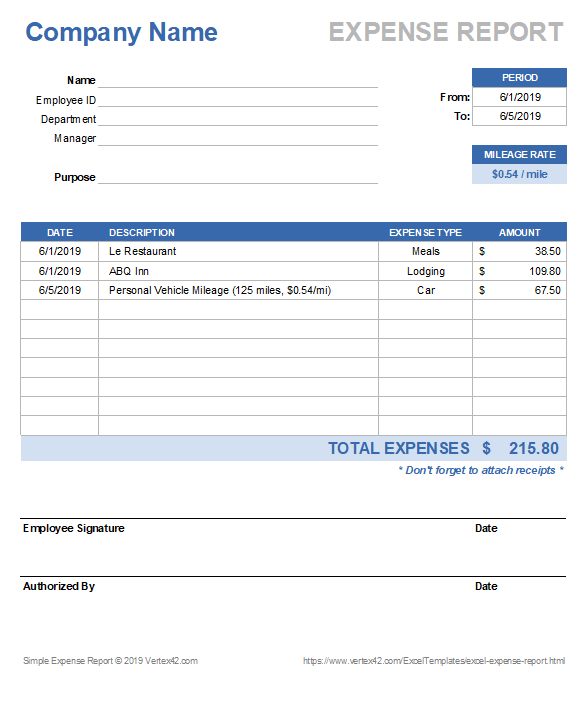

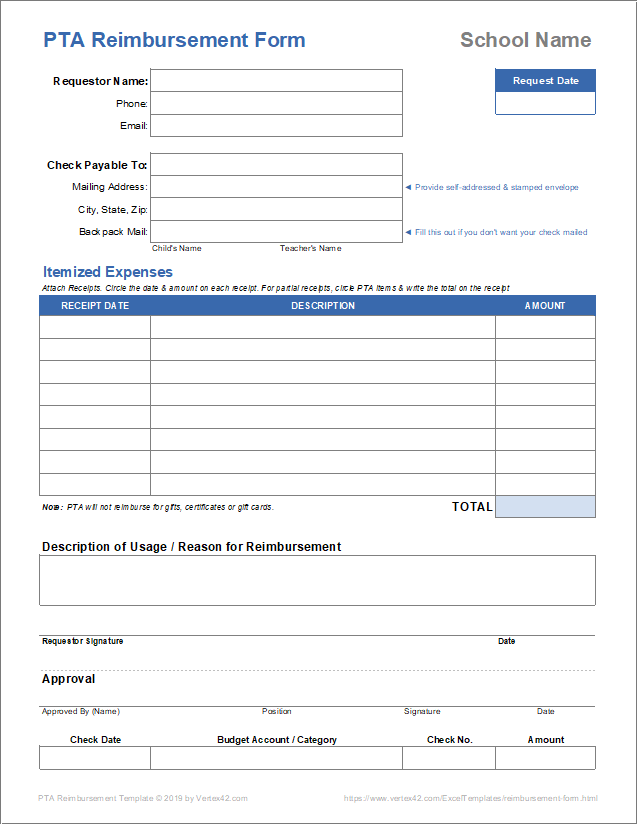

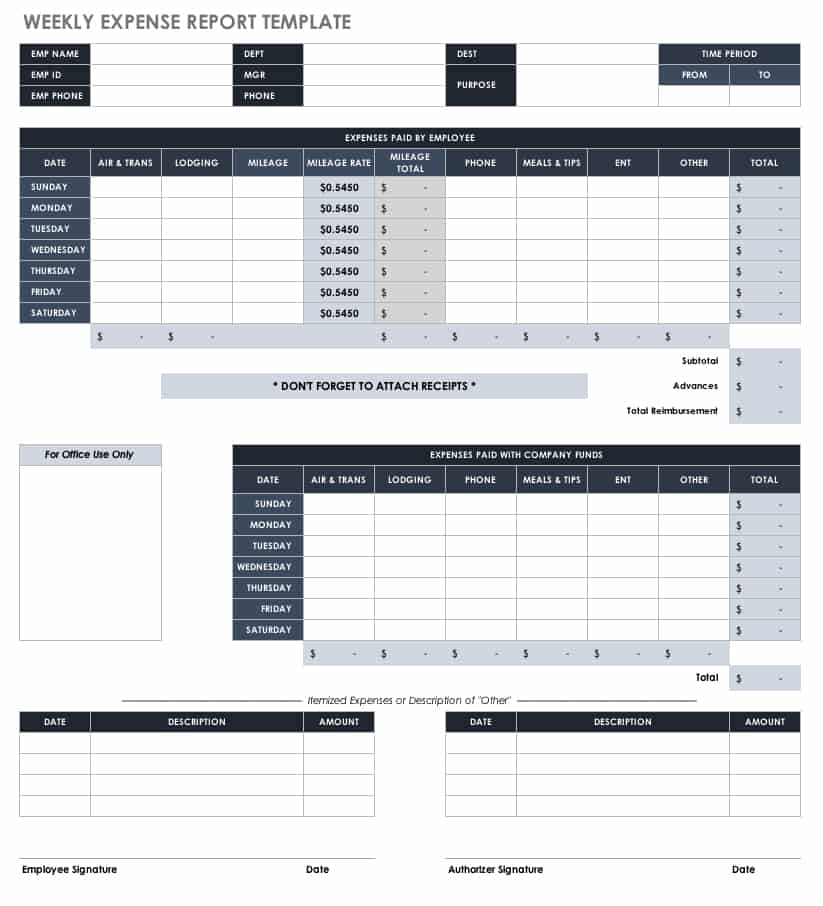

Free Expense Reimbursement Form Templates

Free Expense Reimbursement Form Templates

Use the Tier One rate for the business portion of the first 14000 kilometres travelled by the vehicle in a year.

Business travel reimbursement rate 2019. Effective January 1 2019 the mileage rate allowed for use of a personal vehicle on business is 58 cents per mile. A reimbursive travel allowance is where an allowance or advance is based on the actual distance travelled for business purposes that is excluding private use. Publication 535 Business Expenses PDF.

58 per kilometre for the first 5000 kilometres driven. 575 cents per mile driven for business use down one half of a cent from the rate for 2019 17 cents per mile driven for medical or moving purposes down three cents from the rate for 2019 and 14 cents per mile driven in service of charitable organizations. For prior-year rates see Automobile allowance rates.

In the Northwest Territories Yukon and Nunavut there is an additional 4 per kilometre for travel. 55 per kilometre for the first 5000 kilometres driven. The rate adjusted for 2020 is 575 cents per mile taking into account oil and gas prices inflation economic conditions and the cost of car ownership into calculating the reimbursement rate.

The rate per kilometre is fixed by the Minister of Finance and currently is 382 per kilometre from 1 March 2021. 1 2019 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. Youre traveling away from home if your duties require you to be away from the general area of your tax home for a period substantially longer than an ordinary days work and you.

In fact the last time AMAP rates changed was in April 2012 when the AMAP rate for the first 10000 car and van miles rose from 40p per mile to 45p per mile. The automobile allowance rates for 2018 are. 53 per kilometre driven after that.

Jan 1 2019 March 31 2019. The HMRC AMAP rates for 2019-20 are in. Notice 2019-55 PDF provides the rates that have been in effect since October 1 2019.

In the Northwest Territories Yukon and Nunavut there is an additional 4 per kilometre allowed for travel. The rates apply for any business journeys you make between 6 April 2019 and 5 April 2020. 3 rows 2019 Personal Vehicle Mileage Reimbursement Rates Type Reimbursement Rate per Mile.

The percentage is reduced to 20 if the employer is satisfied that at least 80 of the use of the motor vehicle for the tax year will be for business purposes. The IRS annually issues guidance providing updated per diem rates. Theyre identical to the rates that applied during 2018-19.

Using the Tier One and Tier Two rates. 112019 to present. 14 rows The following table summarizes the optional standard mileage rates for employees self.

Publication 463 Travel Gift and Car Expenses PDF. April 1 2019 June 30 2019. For 2021 they are.

This includes private use travel. Oct 1 2019 Dec 31 2019. The Tier Two rate is for running.

59 per kilometre for the first 5000 kilometres driven. 50 rows FY 2019 General Rates. 58 cents per mile driven for business use up 35 cents from the rate for 2018 20 cents per mile driven for medical or moving purposes up 2 cents from the rate for 2018 and.

14 cents per mile driven in service of charitable organizations. The Tier One rate is a combination of your vehicles fixed and running costs. Kilometre rates for the 2018-2019 income year.

Travel expenses are the ordinary and necessary expenses of traveling away from home for your business profession or job. 52 per kilometre driven after that. 80 of the travelling allowance must be included in the employees remuneration for the purposes of calculating PAYE.

You cant deduct expenses that are lavish or extravagant or that are for personal purposes. The automobile allowance rates for 2019 are.

Free Mileage Tracking Log And Mileage Reimbursement Form Vincegray2014

Free Mileage Tracking Log And Mileage Reimbursement Form Vincegray2014

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

Btn S 2020 Corporate Travel Index Business Travel News

Btn S 2020 Corporate Travel Index Business Travel News

Free Mileage Log Templates Smartsheet

Free Mileage Log Templates Smartsheet

Https Www Theigc Org Wp Content Uploads 2019 04 3b Igc Travel Policy March 2019 Pdf

![]() Free Mileage Tracking Log And Mileage Reimbursement Form

Free Mileage Tracking Log And Mileage Reimbursement Form

Mileage Rates 2019 Irs Mileage Deduction Mileage

Mileage Rates 2019 Irs Mileage Deduction Mileage

Free Mileage Reimbursement Form 2021 Irs Rates Word Pdf Eforms

Free Mileage Reimbursement Form 2021 Irs Rates Word Pdf Eforms

Free Mileage Log Templates Smartsheet

Free Mileage Log Templates Smartsheet

Free Expense Reimbursement Form Templates

Free Expense Reimbursement Form Templates

Instructions For Form 2106 2020 Internal Revenue Service

Instructions For Form 2106 2020 Internal Revenue Service

Free Expense Reimbursement Form Templates

Free Expense Reimbursement Form Templates

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

Gas Mileage Reimbursement Rates For 2020 And 2021 Workest

What Are The Irs Mileage Rates Updated 2021 Bench Accounting

What Are The Irs Mileage Rates Updated 2021 Bench Accounting

The Basics Of Employee Mileage Reimbursement Law Companymileage

The Basics Of Employee Mileage Reimbursement Law Companymileage

![]() Free Mileage Tracking Log And Mileage Reimbursement Form

Free Mileage Tracking Log And Mileage Reimbursement Form